Weekly review: MSCI reclassification propels KSE-100 to record high

Benchmark 100-share index increases 1,900 points or 3.8% week-on-week

Benchmark 100-share index increases 1,900 points or 3.8% week-on-week

The outgoing week witnessed bulls hurrying to buy equities ahead of the MSCI announcement expected on May 15, 2017 (early hours of May 16, 2016 in Pakistan). Unsurprisingly, activity remained concentrated in heavyweight stocks that are expected to be included in the main and small cap MSCI index.

Among major sectors, commercial banks (+5.5% week-on-week) and oil and gas sector (+7.0% week-on-week) led the gains with the former primarily on account of MSCI inspired euphoria, while gains in latter were explained by a rebound in oil prices. Overall repositioning helped index close at historic high level of 51,751 points (+3.8% week-on-week).

Stocks including HBL, MCB, Lucky Cement, Oil and Gas Development Company and Pakistan Petroleum Limited drove the index contributing 856 points. On the other hand, stocks including Pakistan International Bulk Terminal (PIBTL), Fauji Fertilizer Company Limited (FFC), Engro Fertilizer, Attock Cement and Hascol withheld 51 points from the index.

On the sector front; oil and gas exploration sector outperformed the market growing by 7% driven by higher oil prices; followed by commercial banks that were up 5%. On the contrary, transport sector was down 2% as pressure was seen in PIA and PIBTL stocks.

Local institutional investors such as banks and local companies also booked profits with $3.1 million and $8.2 million worth of selling during the weak, while individuals bought assets ahead of MSCI rebalancing with $7.4 million worth of purchases.

Foreigners remained net sellers during the week with a net FIPI outflow of $2.6 million. However, trading activity picked up in the week with average daily traded and average daily traded value witnessing an increase of 32.7% week-on-week and 34.6% week-on-week, respectively.

Individuals (+$7.4 million) were biggest buyers while; most of the selling was concentrated in Power ($2.3mn) and food & personal care ($1.2 million), while foreigners bought $2.3 million of cements.

Winners of the week

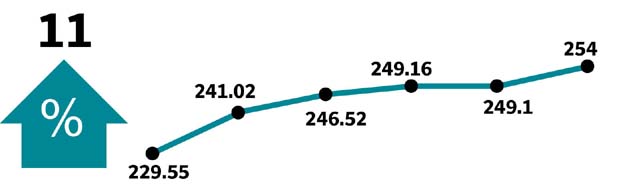

Adamjee Insurance

Adamjee Insurance Company Ltd underwrites insurance. The company offers fire, marine, automobile, engineering and miscellaneous coverages. The engineering coverage includes contractor’s all risk, plant and machinery, electronic equipment and machinery insurance, and excise and customs, maintenance, and performance bonds. Miscellaneous includes health, accident and liability.

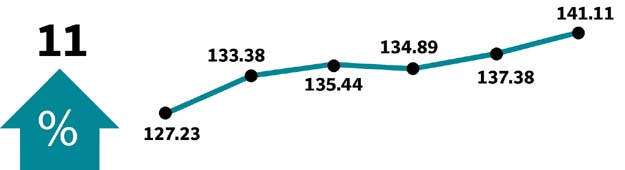

International Steels Limited

International Steels Ltd manufactures steel. The company produces cold rolled sheet and hot dipped galvanised sheet steels. International Steels serves the construction, appliances, automotive, agricultural implements and packaging industries.

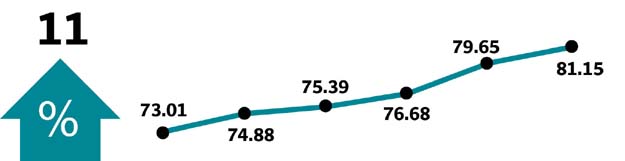

MCB Bank Limited

MCB Bank Ltd is a full service commercial bank. The bank offers a wide range of financial products and advice to personal and corporate customers, including online banking services.

Losers of the week

Indus Dyeing

Indus Dyeing & Manufacturing Company, Ltd manufactures and sells yarn.

Pak Internationl Container Terminal

Pakistan International Container Terminal operates a container shipping facility in Karachi.

Attock Cement

Attock Cement Pakistan Limited manufactures and sells cement and related products. The company is part of the Pharaon group, which in addition to investments in the cement industry also owns interests in the oil and gas sector.

Published in The Express Tribune, May 14th, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1733130350-0/Untitled-design-(76)1733130350-0-208x130.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ