Ecstatic investors boost index 2,132 points following Panama verdict

Weeks of stress fades away as bourse gains 4.5% week-on-week

Weeks of stress fades away as bourse gains 4.5% week-on-week. PHOTO: FILE

During the time the verdict was announced, the index saw its greatest intra-day rise of 1,906 points after investors, sidelined due to the pending verdict, bought shares in droves.

The benchmark-100 index ultimately gained 4.5% week-on-week, settling at 49,709 points and inching closer to its record high.

On Thursday, the cat was out of the bag and while the judgment was not entirely in favour of the PM, as it ordered further probe through a joint investigation team, the decision was cheered by the investors as the index shot up.

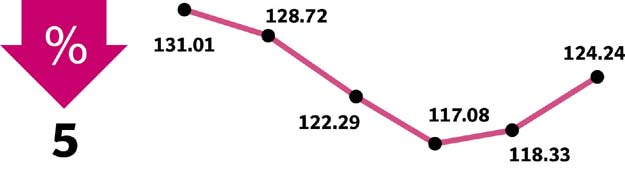

Within the sectors; Oil Marketing Companies, autos, steel, tech and exploration and production outperformed the broader market, gaining between 7.4%-6.1% week-on-week, while fertilisers (+4.5%) tracked the market, whereas cement, power, chemical and banks underperformed with returns in the range of 4.2%-2.6%.

Panama verdict: The 10 minutes when many made millions

Stocks driving the index were Hubco (+8.3%; +155 points), UBL (+5.9%; +132 points), Engro (+6.8%; +122 points), Pakistan Petroleum Limited (+7.4%; +114 points) and Oil and Gas Development Company (+4.8%; +92 points).

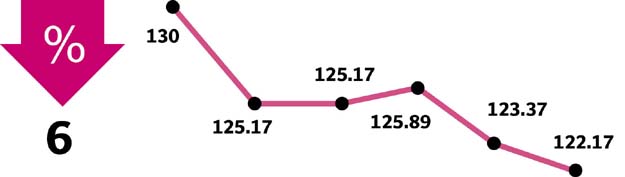

MCB (-2.5%), Interional Steel Limited (-5.2%), Attock Refinery Limited (-5.6%), Nestle (-1.1%) and Nishat Power Limited (-2.7%), contributed negatively with 101 points.

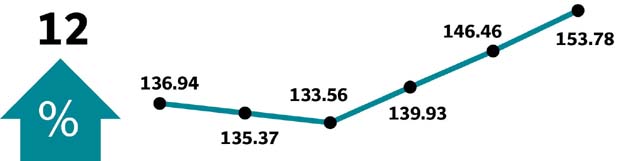

In terms of price performance Pak Elektron (PAEL, +12.6% week-on-week) and Sui Northern Gas Pipeline (SNGP, +12.3%) were the best performing 100-index stocks with SNGP closing at an all-time high price of Rs153.78/sh, while PAEL at Rs104.72/sh is also closing in on its all-time high of Rs108/sh.

During the week, Amreli Steel Ltd announced expansion in its billets and rebar capacity while Punjab government unveiled its plan to launch the Orange cap scheme as a youth employment initiative. This initiative is expected to benefit PSMC and the stock was seen closing at its upper limit during the day.

Subsequently, trading activity also improved with average daily traded volumes increasing by 62% week-on-week to 278 million shares and average traded value rising by 81% week-on-week to $158 million/day.

Market watch: KSE-100 increases another 965 points

In terms of participation, local mutual funds were largest net buyers of $78 million (up 1423% week-on-week). However, local individuals and foreign investors turned out to be major net sellers worth $52 million and $32 million, respectively.

Winners of the week

Sui Northern Gas

Sui Northern Gas Pipelines Limited purchases, purifies, transmits, distributes and supplies natural gas, in addition to marketing Liquefied Petroleum Gas.

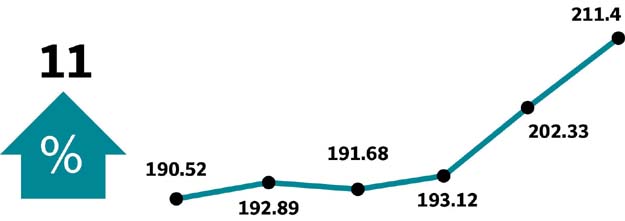

Cherat Cement

Cherat Cement Company Limited manufactures and sells cement and clinker.

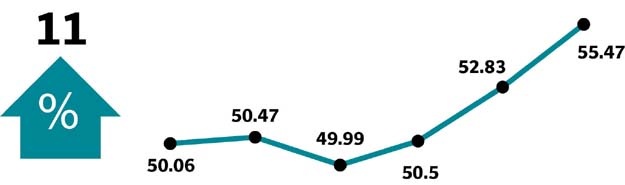

TRG Pakistan

TRG Pakistan operates as an information technology company. The company provides business support and software services to companies. TRG Pakistan manages call centres and offices located in Pakistan and elsewhere throughout the world.

Losers of the week

Feroze 1888

Feroze 1888 Mills Ltd manufactures and sells a wide range of cotton towels and fabrics.

Attock Refinery

Attock Refinery Limited, a subsidiary of the Attock Oil Company, specialises in the refining of crude oil.

International Steels Ltd

International Steels Ltd manufactures steel. The company produces cold rolled sheet and hot dipped galvanised sheet steels. International Steels serves the construction, appliances, automotive, agricultural implements and packaging industries.

Published in The Express Tribune, April 23rd, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ