Weekly review: KSE index declines 0.5% as volumes dwindle

Investors remain sidelined ahead of monetary policy announcement.

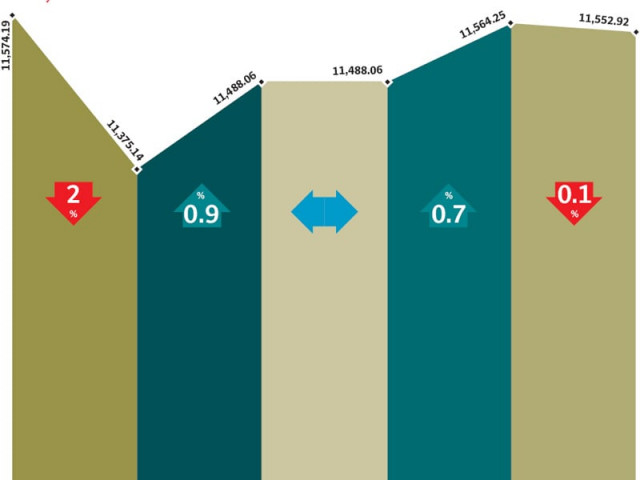

Bearish trend continued to prevail in the Karachi stock market as the KSE 100-share index declined 0.5 per cent (54 points) during the shortened week that ended on March 25.

Trade volumes dropped 44 per cent over the previous week, as investors chose to remain on the sidelines ahead of the State Bank of Pakistan’s (SBP) monetary policy announcement for the next two months.

There was no major news flow during the week, which was shortened on account of Pakistan Day on March 23. The index had declined 3.6 per cent in the previous week amid a possibility of foreign sell-off.

Surprisingly, foreign flows made a U-turn and returned to the positive after two consecutive weeks of outflows. The market saw net foreign buying of $4.8 million after net outflows of $6 million and $16 million, respectively, in the previous two weeks.

The return of foreign buying could be a direct result of Moody’s maintaining its B3 credit rating for Pakistan with a stable outlook; news investors viewed as favourable.

Investors were also keenly waiting for the announcement of the monetary policy, although a majority of analysts were of the view that status quo will be maintained in light of improving inflation numbers, reduction in overall government borrowing from SBP and a decline in treasury bill yields.

The Margin Trading System (MTS) also experienced a steady second week, as investors were slowly becoming comfortable with the financing mechanism and the new rules. MTS investment stood at Rs48 million for the week, compared with Rs25.7 million in the opening week. Average financing rate also improved to 17.6 per cent from 19.9 per cent in the previous week.

According to sector-wise performance, the banking sector suffered a setback, as data on non-performing loans (NPLs) was released during the week. NPLs increased by Rs54 billion in the last quarter of 2010 – the highest increase in two years. The cement sector, on the other hand, had something to cheer about after prices rose following the increase in taxation rates announced last week.

Volumes remained low throughout the week, despite the index plunging and climbing in the first couple of days. Average daily volumes stood at 62.56 million shares, down 44 per cent over the previous week, reflecting the lack of investor enthusiasm.

Average daily value, similarly, plunged 38.7 per cent to Rs3.13 billion, and most of the activity was restricted to second and third tier stocks. The index’s market capitalisation also declined by one per cent and stood at Rs3.08 trillion by the end of the week.

What to expect?

The monetary policy could have shaken things up a bit at the bourse if a surprising announcement was made by State Bank. However, the central bank kept the rate unchanged and thus it should not be expected to impact the market substantially.

The return of foreign flows resulted in a sigh of relief from local investors and future foreign flows can still be expected to dictate the direction of the market in coming weeks. Investors are advised to keep an eye on the direction of the flows.

Monday, March 21

The stock market tumbled as investor confidence remained low following continued foreign outflows and deteriorating law and order situation in the city.

Local investors preferred to stay sidelined after a massive outflow of $16 million last week.

Tuesday, March 22

The outflow of foreign investments stemmed and local participants were seen taking fresh positions at Karachi Stock Exchange (KSE), helping it rise 113 points.

Following a massive outflow of about $16 million during the previous week, foreign investors reemerged as net buyers at the bourse.

Wednesday, March 23

The market was closed on Wednesday owing to a public holiday on account of Pakistan Day.

Thursday, March 24

The stock market rose as bullish sentiments prevailed on expectation of maintaining of status quo in the upcoming monetary policy. Rally in the Karachi bourse was led by oil stocks as crude prices continued their upward march and crossed $116 a barrel in the international market on the back of unrest in the Middle East.

Friday, March 25

The stock market closed down marginally as investors preferred to book profits ahead of the monetary policy announcement on Saturday.

Published in The Express Tribune, March 27th, 2011.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ