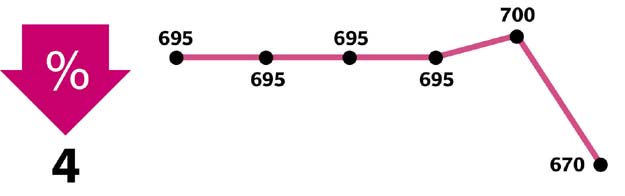

KSE-100 continues losing streak, falls 0.6% week-on-week

Index heavyweight financials and oils down as volumes remain low

Index heavyweight financials and oils down as volumes remain low. PHOTO:FILE

Investors maintained a wait-and-see approach ahead of the awaited verdict on the Panama leaks case.

The only respite came at the end of the week when in a “TGIF-themed rally”, as dubbed by Topline Securities, the local bourse gained 533 points that helped the index pare-off the weeks’ losses.

Market talk suggested the reason behind the KSE-100’s downwards spiral is that investors are sitting on the sidelines waiting for political uncertainty to unravel before going long again.

Additionally regulatory action taken by Securities and Exchange Commission of Pakistan against a broker kept sentiments negative.

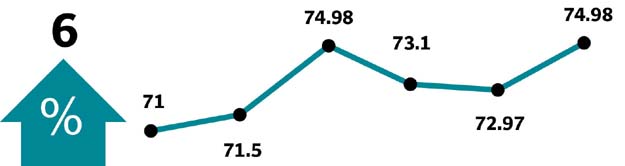

Investors continued their cherry picking approach with UBL (+3.2%), Lucky Cement (+3.5%), Oil and Gas Development Company (+2.6%), Pakistan Petroleum Limited (+2.7%) and Nestle (+4.2%WoW) cumulatively contributing 266 points to the index.

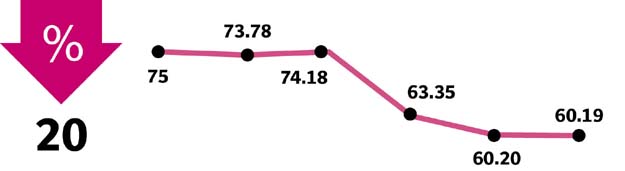

National Bank of Pakistan (-10.3%), Engro Corp (-3.6%), MCB (-3.1%), Fauji Fertilizer Company Limited (-3.0%) and HBL (-0.9%WoW) dragged the index down by 273 points.

NBP declined significantly (-10.3% week-on-week) during the outgoing week after Elixir Securities research report highlighted concerns on possible dent to the bottom-line over pension obligations which is already under litigation phase.

However, Sui Southern Gas Company gained 7.2% week-on-week as the company announced hefty investment plan of Rs65 billion on 1.2BCF capacity pipeline for transportation of RLNG.

Within the big cap sectors, exploration and production (+2.5% week-on-week) was the top performer as crude oil prices gained over 2% during the week, with further gains likely due to US attack in Syria sending shockwaves through global markets and raising concerns that the conflict could spill-over in the oil-rich region.

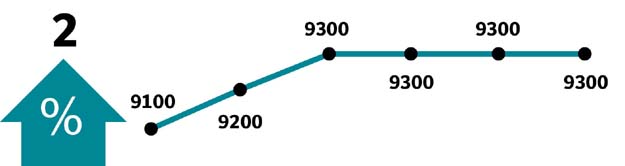

Banks (-$16.8 million) were the biggest sellers while foreigners were buyers of $9.3 million during the week as against selling of $19 million last week; with most of the buying concentrated in banks ($5.9 million), exploration and production’s ($1.8 million) and fertiliser ($1.8 million); while textile ($-0.8mn) saw some selling.

Average trading volume declined significantly by 37% week-on-week to 156 million shares as compared to 248 million in the previous week.

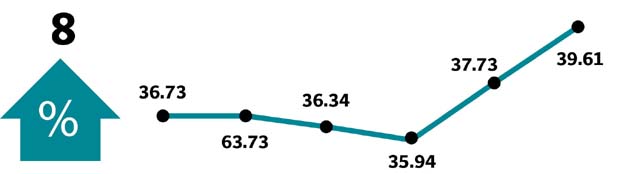

Winners of the week

Sui Southern Gas

Sui Southern Gas Company Limited transmits and distributes natural gas, and constructs high pressure transmission and low pressure distribution systems. The company’s transmission system extends from Sui in Balcohistan to Karachi in Sindh.

Meezan Bank

Meezan Bank Limited is a commercial bank dedicated to Islamic banking. The bank provides a range of deposit products, loans and other products through offices located throughout Pakistan.

Nestle Pakistan Limited

Nestle Pakistan Limited manufactures, imports and sells dairy products, confectioneries, culinary products and fruit juices. The group’s products include milk, butter, cream, noodles, coffees, and dietary and infant products.

Losers of the week

National Bank of Pakistan

National Bank of Pakistan is a government-owned bank which provides a wide range of banking and financial services to corporate, institutional, commercial, agricultural, industrial and individual customers throughout Pakistan.

EFU General Insurance

EFU General Insurance Limited is an insurance provider. The group supplies a number of lines of coverage, including fire, marine, aviation, transport, motor and miscellaneous.

Indus Dyeing

Indus Dyeing & Manufacturing Company Ltd manufactures and sells yarn.

Published in The Express Tribune, April 9th, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ