The global lender also maintained its economic growth rate projection at 5% for Pakistan this year, lower than the 5.7% target the government has set. The IMF also, for the first time, admitted that the current account deficit - the gap between external payments and receipts - would be almost double than its initial projections of 1.5% of Gross Domestic Product.

Pakistan admitted that the budget deficit target of 3.8% of GDP will also be missed and will remain at 4.1%.

IMF pledges support to Pakistan to address economic challenges

The current account deficit is expected to remain at 2.9% of the GDP at the end of the current fiscal year, said the IMF. This has also raised questions over the IMF’s ability to make projections, which are near to actual results.

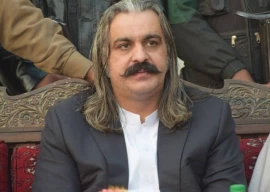

The IMF issued the statement after conclusion of weeklong talks with Pakistani authorities held under its Article-IV. Finance Minister Ishaq Dar led the Pakistani team along with State Bank of Pakistan (SBP) Governor Ashraf Wathra.

“A number of challenges in the fiscal, external, and energy sectors could affect the hard-won stability gains in the period ahead,” said Harald Finger, the Washington-based IMF Mission Chief for Pakistan.

Finger said that economic policies in the period ahead need to focus on preserving the hard-won stability and addressing emerging as well as medium-term challenges, notably in the fiscal, external, and energy sectors.

Pakistan's economy is out of danger, says IMF chief

IMF’s recommendation

He added that in this context, the IMF mission called for strong efforts with respect to fiscal consolidation and the implementation of key structural reforms, and vigilance in managing the country’s external position.

The IMF’s statement is also an admission of its own failure, as the Fund kept its eyes closed during the three-year period of $6.6 billion programme aimed at claiming a victory at the end. It had given almost one and a half dozen waivers to Pakistan so that Islamabad could ‘successfully conclude’ the programme for the first time in 15 years.

Meanwhile, the higher than projected current account deficit would mean that Pakistan’s financing requirements multiply. This means more foreign expensive borrowings.

The IMF had estimated almost $11 billion financing requirements for this fiscal year - a figure that now appears understated by at least $4 billion, according to independent economists.

IMF distances itself from Ishaq Dar's 'Finance Minister of the Year' award

During the first seven months of this fiscal year, Pakistan booked $5.47 billion as current account deficit, equivalent to 2.6% of the GDP.

During the past four years, the government has, however, claimed a victory on the economic front by increasing foreign currency reserves through expensive foreign borrowings and cutting down budget deficit by parking a significant amount of obligations outside the budget, according to sources in the Finance Ministry.

IMF’s fear

Finger said that stronger fiscal consolidation efforts would be needed to make up for the lower-than-expected revenue in the first half of this year and achieve a further budget deficit reduction next year. The budget deficit during the first half of this fiscal year also remained higher than projections.

The IMF said greater exchange rate flexibility and efforts to improve export sector productivity are needed to address the widening trade deficit as well as strengthen the economy’s ability to absorb medium-term CPEC-related and other capital outflows, he added.

IMF clears way for final $102m tranche

The Fund said that the headline inflation is expected to be contained at 4.3%, which is lower than this year’s annual target.

Over the medium term, economic growth could accelerate to about 6% on the back of stepped-up CPEC and other investments, improved energy supply, and continued structural reforms, said Finger. However, for this year, it maintained the growth projection at 5%. It added improved global economic conditions, rising investment related to the CPEC and recovering agriculture would boost growth prospects this year.

However, at the same time, slower-than expected growth of large-scale manufacturing and stagnant exports are weighing on growth prospects, said Finger.

The IMF urged Pakistan to bring the power distribution sector to full cost recovery aimed at ensuring long-term success of new energy initiatives and minimize fiscal costs.

IMF chief warns slowing productivity risks living standards drop

During the programme period, Pakistan could not privatise a single power distribution or generation company. Yet the IMF kept giving good economic health certificates after every quarter.

In reality, the energy sector circular debt have mounted up to Rs385 billion, as admitted by Minister for Water and Power on Monday.

The IMF said that after three years of reforms, Pakistan has strengthened its macroeconomic resilience and economic outlook, providing an opportunity to build on recent progress with structural reforms and set the economy on a higher growth path.

“Maintaining the reform momentum will be critical for Pakistan to achieve its broader economic objectives, and continued effort will be important in the period ahead,” said Finger.

COMMENTS (1)

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ