Govt forgoes 15% tax to support foreign exchange reserves

Decision comes after foreign commercial banks assisted Pakistan in building reserves

Decision comes after foreign commercial banks assisted Pakistan in building reserves. PHOTO: FILE

The government took these loans after it failed to attract sufficient non-debt creating inflows, like enhancing exports and foreign direct investment for meeting its external financing requirements.

Pakistan’s debt dilemma

The decision to forgo the tax was taken by the federal cabinet quietly in early February, without involving the National Assembly. The cabinet also gave ex-post facto approval of these loans that the Ministry of Finance had borrowed by bypassing the competitive process, which had also raised transparency concerns.

Nevertheless, the move to waive off tax was aimed at making a claim that the government obtained these loans at below 5% interest rate in dollar terms. By including the 15% tax, the rate could have been above 5%.

“The exact quantum of tax loss cannot be determined due to applicability of various bilateral avoidance of double taxation treaties,” said Federal Board of Revenue (FBR) spokesman Dr Mohammad Iqbal.

He had been requested to share details about the losses that the FBR sustained due to tax exemption on the profit that the foreign banks would earn on $2.5 billion lending.

The summary to exempt 15% tax on interest income of the Credit Suisse AG, United Bank Limited, Allied Bank Limited, Noor Bank of UAE, Standard Chartered, Dubai Islamic Bank and China Development Bank was moved by the Finance Ministry, according to official documents.

CREATIVE COMMONS

Pakistan obtained roughly $2.5 billion short-term expensive loans from these banks between November 2013 and September 2016. These loans were obtained at an interest rate ranging up to 4.71% in dollar terms. Most of these loans were obtained on London Interbank Offered Rate (Libor) of three-month floating average plus 4%, which comes to around 4.71%. In one case, the loan was obtained at three-month floating Libor plus 3.25%, which translates into roughly 3.6%.

At the start of 2017, the average three-month Libor interest rate has crossed 1% level for the first time in nine years due to hope of interest rate normalisation in the United States. This has increased the cost of borrowings for developing countries like Pakistan.

The federal cabinet’s decision would directly benefit the banks that are earning over 4.5% interest rate at a time when the international borrowing cost remains at historically low levels due to abnormally low interest rates.

Every Pakistani now owes over Rs115,000

The Ministry of Finance informed the federal cabinet that “foreign commercial loans are offered with the condition that taxes applicable in Pakistan would not be borne by the lenders”, showed the official documents.

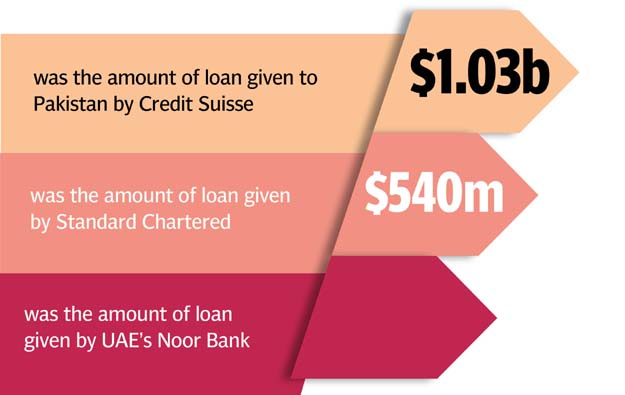

Pakistan obtained $1.03 billion from a syndicate led by Credit Suisse at an interest rate ranging 3.57% to 4.4% for one year, according to official documents. It obtained $540 million from Noor Bank of the UAE at an interest rate ranging from 4.1% to 4.71% for one year. The government took $100 million loan from Standard Chartered at 4.6% interest rate for four years. And it also obtained $70 million loan from Dubai Islamic Bank at 2.82% rate - the lowest rate among all.

In September last year, the Ministry of Finance admitted in a summary moved to seek tax exemptions on issuance of Islamic bond that “the trade account has been worsening and consequently pressures are building on the balance of payments”.

Pakistan’s official foreign currency reserves - largely built by borrowings, have again started depleting after the end of the International Monetary Fund. As of March 3, the foreign currency reserves held by the central bank stood at $17.1 billion.

After assuming power, the current government has borrowed over $3 billion from foreign commercial banks, in addition to $4.5 billion that it borrowed by issuing dollar-denominated Euro and Sukuk bonds during the last three years.

Meanwhile, the current account deficit has been pushed to $4.7 billion in first seven months of the ongoing fiscal year due to growing China-Pakistan Economic Corridor-related imports, decline in exports, absence of Coalition Support Fund till recently and the slowdown in remittances.

The trade deficit - gap between exports and imports - peaked to new historic high of $20.2 billion during July-February.

Published in The Express Tribune, March 14th, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ