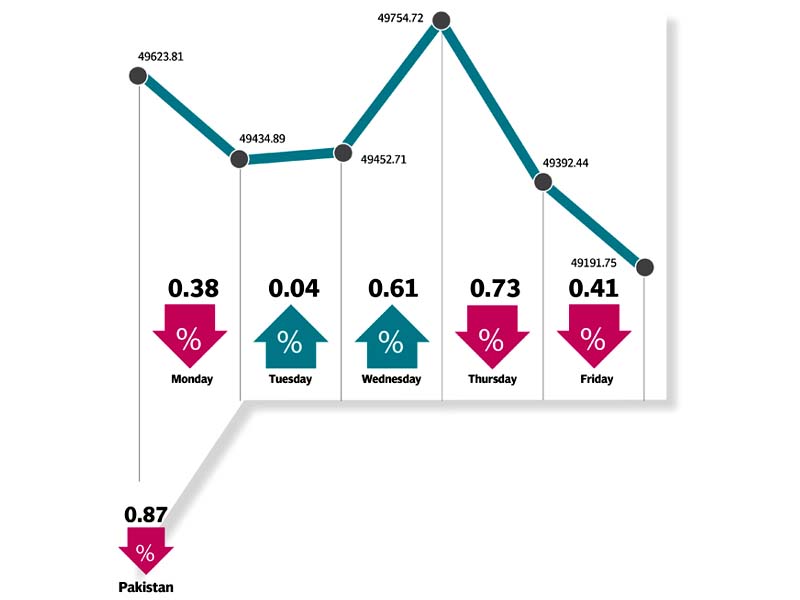

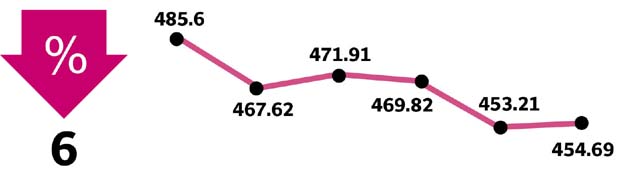

The KSE-100 dipped 432 points, a fall of 0.9% week-on-week, as concerns remained over the Panama case judgment and SECP’s crackdown over in-house badla financing. The benchmark index ended negative in three of the five trading sessions to end at 49,192 points. One positive development, however, was the release of 90% of the Pakistan Stock Exchange sale proceeds to brokerage houses leading to improved liquidity.

Weekly review: Volatile trading results in KSE-100 losing 0.7%

On the sector front, exploration and production’s declined 3.9% week-on-week with Oil and Gas Development Company (-4.3%), Pakistan Petroleum Limited (-3%), Mari Petroleum Company Limited(-5.2%) and Pakistan Oilfields Limited (-2.5%) wiping out 190 points from the index. International oil prices shed 7% on concerns that a persisting supply glut may unravel the OPEC deal.

During the week, Engro Fertilizers announced the conversion of IFC’s $1 million loan into ordinary shares (however this has a negligible dilution impact). A total of 13 Independent Power Producers invoked their sovereign guarantee as their overdue receivables exceeded Rs250 billion.

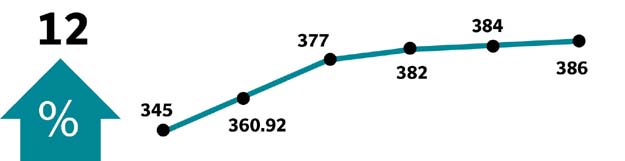

Also, Engro and Sui Southern Gas Company Limited reached a deal to re-gasify additional 200 mmscfd RNLG. Furthermore, cement numbers released by All Pakistan Cement Manufacture Association showed 6% year-on-year growth in dispatches during 8MFY17.

Fauji Fertilizer Bin Qasim Ltd (FFBL) remained the top performer, gaining 5.2% during the week on rumours of possible increase in local DAP prices while the overall sector remained jittery following mixed news flow on delay in reimbursement of subsidy claims and weak urea offtake during Feb-2017.

Major selling was seen in banks and power sectors ($1.3 million).

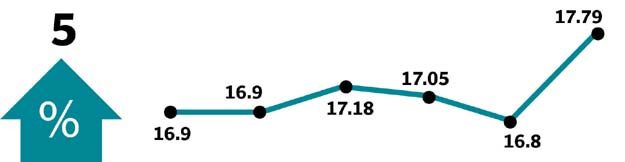

On the macro front, foreign exchange reserves rose by 1.5% week-on-week as the central bank received $350 million under CFS. Moody’s, however, forecasted widening of country’s trade deficit due to increase in oil prices.

Foreigners were net buyers of $15.4 million during the week as against selling of $32.7 million during the previous week.

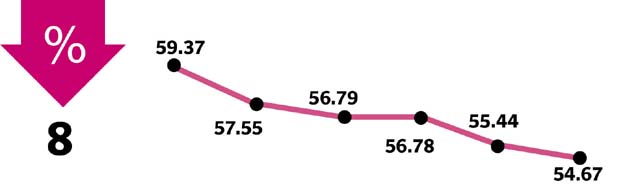

Average trading volumes declined from 354 million shares to 238 million shares (-33% week-on-week).

Winners of the week

Punjab Oil Mills

Punjab Oil Mills Ltd manufactures and sells vegetable ghee, cooking oil and laundry soap.

Soneri Bank

Soneri Bank Limited provides banking services.

Fauji Fertilizer Bin Qasim

Fauji Fertilizer Bin Qasim Limited manufactures purchases, and markets fertilisers. The company produces Granular Urea and DAP. Fauji Fertilizer provides its products to farmers in Pakistan.

Losers of the week

TRG Pakistan

TRG Pakistan operates as an information technology company. The company provides business support and software services to other companies. TRG Pakistan manages call centres and offices located in Pakistan and elsewhere throughout the world.

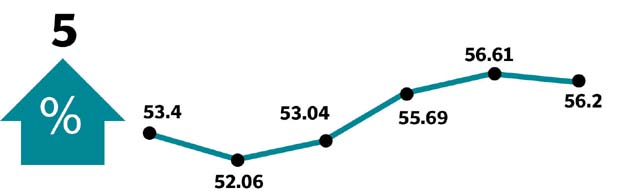

Week-On-Week: SPI rises 0.59%

Attock Refinery

Attock Refinery Limited, a subsidiary of the Attock Oil Company, specialises in the refining of crude oil.

National Refinery

National Refinery Ltd manufactures and distributes lube base oils and petroleum fuels. The company markets its products to customers throughout Pakistan.

Published in The Express Tribune, March 12th, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1732486769-0/image-(8)1732486769-0-270x192.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ