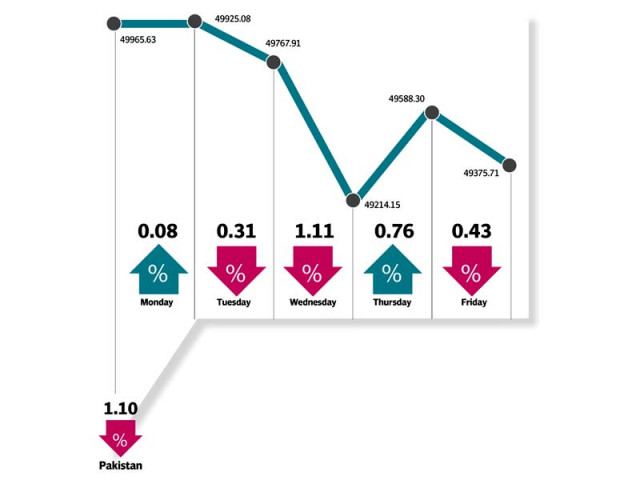

Weekly review: Index loses 1.1% as negative sentiment continues

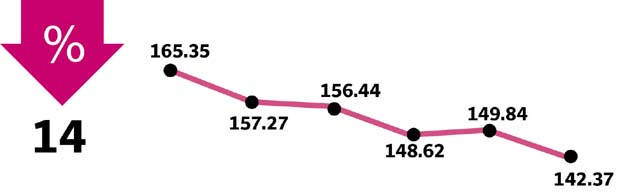

Benchmark index falls 550 points during the week, closes at 49,375.71

Benchmark index falls 550 points during the week, closes at 49,375.71

After starting the week on a positive note, rumours on a stay order over anti-dumping duty on steel products led to heavy selling in scrips like International Steel Limited and Aisha Steel Limited.

As the rumours settled, the same stocks partially recovered their losses.

However, the law and order situation played its part in making investors cautious as eight bomb blasts took place in the country in the space of five days, resulting in a decrease of overall trading volumes.

Of the key sectors, outperformers during the week were insurance (+3.7% week-on-week), and oil marketing companies (+2.2% week-on-week).

On the other hand, heavyweights such as banks (-1.2% week-on-week), autos (-0.8% week-on-week) and cements (-0.8% week-on-week) underperformed in the broader index during the week.

Apart from the volatile security situation in the country, weaker than anticipated results during the week (especially Oil & Gas Development Company) contributed towards the decline.

Millat Tractors, along with its result, announced its plan of considering entering the consortium that is setting up a Greenfield plant of Hyundai Motors, which resulted in the stock closing on its upper circuit for the day.

During the week, results of some blue-chips were released that garnered mixed reactions from the investors. HBL attracted positive flows after it posted earnings per share (EPS) of Rs21.69 for CY16, while UBL moved into the red after it posted an EPS of Rs22.65 for CY16.

In the cement sector, DG Khan Cement and Fauji Cement posted an EPS of Rs10.28 and Rs0.94, respectively, for the 1HFY17, impact of which largely remained neutral on both stocks.

On Friday, Engro posted its result for CY16, with a below-than-expected divided of Rs4 per share, which led to heavy selling.

Foreigners remained net buyers during the outgoing week, mopping up $4.25 million worth of shares, but down by 21% week-on-week.

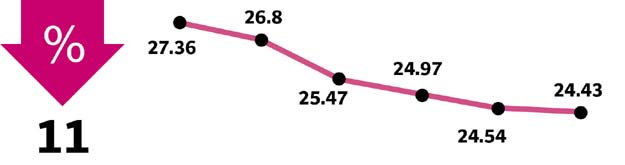

With weakened sentiments, overall participation also remained lacklustre with average traded volumes falling by 15% to 354 million shares and average daily turnover by 5% to $168 million.

Winners of the week

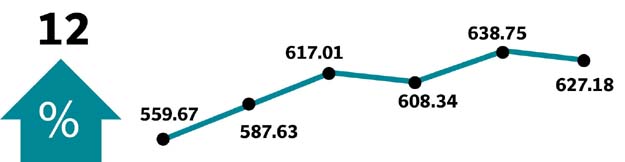

Shell Pakistan

Shell Pakistan Limited markets petroleum and petrochemical products. The company also blends and markets different types of lubricating oils.

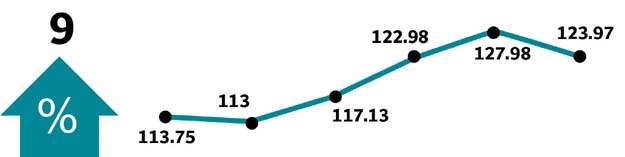

Jubilee General Insurance

Jubilee General Insurance Company Limited is an insurance provider. The group provides a number of lines of coverage, including health, fire, marine and miscellaneous.

Jubilee Life Insurance

Jubilee Life Insurance Company Ltd is a general insurance company, which offers both individual life insurance and corporate business insurance. The company’s individual products include life, personal accident, critical illness, and investment insurance. Jubilee’s corporate products include group life, health, and pension schemes.

Losers of the week

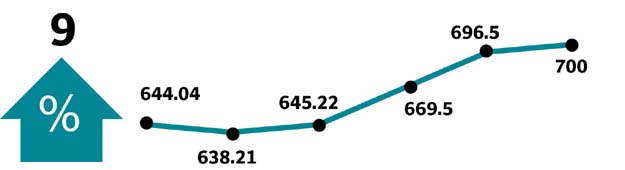

International Steels Limited

International Steels Ltd manufactures steel. The company produces cold rolled, sheet, and hot dipped galvanised sheet steels. International Steels serves the construction, appliances, automotive, agricultural implements, and packaging industries.

Ferozesons Laboratories

Ferozesons Laboratories Ltd manufactures and sells pharmaceutical products.

Askari Commercial Bank

Askari Commercial Bank Limited provides commercial banking services. The bank has branches in Pakistan, Azad Jammu and Kashmir and Bahrain.

Published in The Express Tribune, February 19th, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ