As PSX advances, capital gains tax collection also rises 48%

NCCPL received Rs5.53 billion in CGT for Jul-Nov 2016

A sign of the Pakistan Stock Exchange is seen on its building in Karachi, Pakistan January 11, 2016. PHOTO: REUTERS

The benchmark KSE 100-share Index successfully sustained - for the first time - the 50,000-point level on Thursday, giving a return of 32.84% in the fiscal year to date.

PSX becomes regional capital market, may launch CPEC bonds

The index started its advance from 37,966.76 points on the first trading session of the fiscal year on July 4, 2016. It closed at 50,192.36 points on Thursday.

The National Clearing Company of Pakistan Limited (NCCPL), which collects capital gains tax (CGT) on share transactions at the stock market, told The Express Tribune that it had collected Rs5.53 billion for the first five months (July-November) of the current fiscal year.

The collection was over 48% higher than the Rs3.72 billion collected in the same five months of previous year.

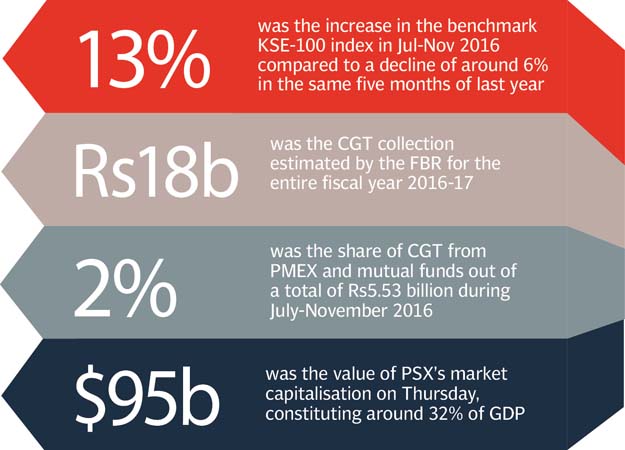

The benchmark index increased approximately 13% in the five months compared to a decline of around 6% in the same period of last year. Arif Habib Limited Chief Executive Officer Shahid Ali Habib commented that the increased CGT collection came on the back of the boom in the stock market.

“The higher tax collection has a direct link with booming share prices, as it is collected when investors sell shares for profit,” he said.

The CGT law allows investors to offset capital losses against capital gains in each fiscal year. It is computed and collected on a month-on-month basis and treated final as on June 30 every year.

At present, NCCPL is in the process of CGT collection for December 2016.

The Federal Board of Revenue (FBR) has estimated the CGT collection at Rs18 billion for the entire fiscal year. This includes the CGT on transactions made in the futures market, Pakistan Mercantile Exchange (PMEX) and mutual funds.

“The share of CGT from PMEX and mutual funds stands at a meagre 2% of the total of Rs5.53 billion during July-November 2016,” said an NCCPL official.

The high collection of CGT at around Rs18 billion by the FBR suggested that the market would see securities prices go up in a majority of days during the remaining five months (February-July) of the current fiscal year.

Earlier, Arif Habib Limited had forecast that the benchmark index would close at around 50,500 points on the last day of the current fiscal year.

PSX Managing Director Nadeem Naqvi recently projected that the market would rise to around 60,000 points. He, however, did not give a time frame.

PSX Chairman Munir Kamal took a more optimistic view, saying the market capitalisation should be equivalent to the size of the country’s economy (gross domestic product) at $300 billion.

PSX market capitalisation - the total value of all listed companies’ shares in the market - stood on Thursday at over $95 billion (Rs10,003 billion), constituting around 32% of GDP.

CGT rates

The government imposed 5% CGT on the sale of futures contract at PMEX with effect from July 1, 2016 and imposed 10-25% CGT on transactions in mutual funds.

PSX emerges as Asia’s best-performing market in 2016

In case of transactions at the PSX, the CGT comes in various slabs in relation to the holding period of shares by the investors.

Investors pay a maximum of 18% (15% for tax return filers) CGT if they sell shares in less than one year from the date of purchase. The tax rate is 16% (12.5% for the filers) if they hold securities for more than one year, but sell within two years.

The tax rate further comes down to 11% (7.5% for the filers) for the holding of securities for more than two years but not more than four years. Similarly, if the investors sell the securities four years after the date of purchase, then there is no CGT.

Published in The Express Tribune, January 27th, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ