Market watch: Index closes at yet another record high

Benchmark KSE 100-share Index gains 242.03 points

PHOTO: AFP

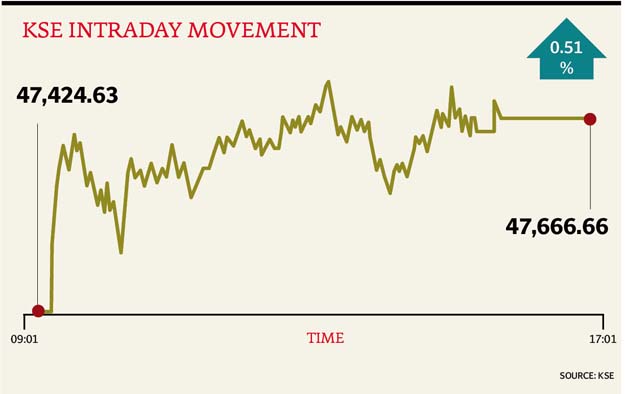

At close on Wednesday, the Pakistan Stock Exchange’s (PSX) benchmark KSE 100-share Index finished with a rise of 0.51% or 242.03 points to end at 47,666.66 - its highest finish yet.

Elixir Securities, in its report, stated that benchmark KSE-100 Index maintained green throughout however mild intra-day profit taking primarily in index names kept investors on the lookout.

“Oils ended the day lower as they tracked volatile global crude while fertilisers that came in limelight over better off take numbers continued to hold ground, along with pharmas and select illiquid industrials and materials that edged up on possible end of the year window dressing,” said analyst Faisal Bilwani.

“Notables that led volumes were mostly small cap speculative plays with the exception of Fauji Cement (FCCL PA +5%) that added to recent gains on bets that company will have full capacity sooner than expected (to recall, FCCL’s Line II suffered a major damage in May that put near 68% of its 3.4 million tons of capacity out of production),” added Bilwani.

Meanwhile, JS Global analyst Nabeel Haroon said the market continued its positive momentum as the index gained around 242 points to close at 47,667 level.

“Fertiliser sector extended its gain as the sector gained to close (+1.2%) higher than its previous day close on the back of healthy fertiliser off take numbers for the month of Nov 2016. FFBL (+3.2%) and FATIMA (+2.6%) were major gainers of the aforementioned sector,” the analyst commented.

“Cement sector continued to garner investor interest on the back of investor anticipation of positive growth in cement dispatch numbers for Dec 2016. FCCL (+5.0%) and ACPL (+3.8%) were top performers of the aforementioned sector,” he added.

“E&P sector lost value to close in the red zone as crude oil prices declined to trade below $54/bbl level. PPL (-1.2%) was the major loser from the aforementioned sector. SNGP (+3.4%) gained as the gas utility declared its financial result for its 1QFY17 in which company posted an EPS of Rs2.21/share versus LPS of Rs0.86/share in SPLY.

“Moving forward, we recommend investors to sell on strength and wait for correction in the market before taking new positions,” said Haroon.

Trading volumes rose to 390 million shares compared with Wednesday’s tally of 273 million.

Shares of 427 companies were traded. At the end of the day, 282 stocks closed higher, 130 declined while 15 remained unchanged. The value of shares traded during the day was Rs18.6 billion.

Dost Steel Limited was the volume leader with 40.1 million shares, gaining Rs0.99 to finish at Rs11.52. It was followed by Bank of Punjab with 35 million shares, gaining Rs0.84 to close at Rs18.40 and K-Electric Limited with 28.4 million shares, gaining Rs0.05 to close at Rs9.30.

Foreign institutional investors were net sellers of Rs831 million during the trading session, according to data maintained by the National Clearing Company of Pakistan Limited.

Published in The Express Tribune, December 30th, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1733130350-0/Untitled-design-(76)1733130350-0-208x130.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ