Market watch: Index continues downward ride

Benchmark KSE 100-share Index falls 65.79 points

PHOTO: EXPRESS

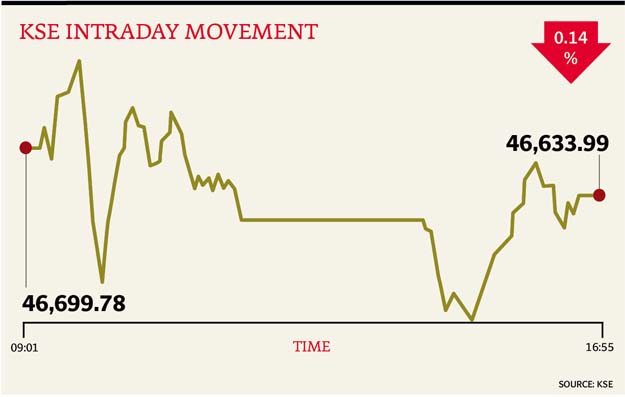

Volumes fell amid listless trading and the index trading in a narrow band of less than 400 points.

At close, the Pakistan Stock Exchange’s (PSX) benchmark KSE 100-share Index finished with a fall of 0.14% or 65.79 points to end at 46,633.99.

Elixir Securities, in its report, stated the market opened positive helped by modest gains in index heavy E&Ps but the benchmark KSE-100 Index soon skidded lower into the red on low volumes as most participants preferred to stay on the side-lines ahead of the weekend.

“Investors were also a little perturbed on law and order concerns as security forces raided offices and houses of few close aides of country’s former president and co-chairperson of major opposition party PPP that coincided with his return to Pakistan after eighteen months of self-exile,” said analyst Ali Raza.

“Volumes on KSE All Share Index plunged by 15% vs on Thursday and 37% vs last week’s average,” the analyst commented.

“United Bank (UBL PA -2.2%) closed lower for the third consecutive day and dented KSE-100 Index the points on profit-taking. Meanwhile, Engro Polymer (EPCL PA +3.8%) gained and traded second best volumes on leader’s board after company notified exchange of a 10% capacity expansion of PVC,” Raza added.

Meanwhile, JS Global analyst Nabeel Haroon was of the view that lacklustre activity prevailed in the market as the index traded between an intraday high of +127 points and intraday low of -257 points to finally close at 46,634 level.

“NCL (+0.68%) continued its positive momentum on the back of textile exports numbers released by PBS, which showed YoY growth of 47.8% in cotton yarn export for the month of Nov-2016,” said Haroon.

“STCL (+3.47%) and CEPB (+4.79%) gained to close in the green zone on the back of the news that NTC will resume its proceedings following LHC order decision against commercial importers of tiles and paper that practice anti-dumping in the country,” he commented.

“HBL (-0.43%), UBL (-2.21%) and MCB (-1.67%) have high weightage in the index and remained under pressure to close in the red zone. PIBTL (-4.66%) was today’s volume leader with 37 million shares traded.

“Going forward, we recommend investors to stay cautious and wait for further correction in the market to accumulate new positions,” the analyst added.

Trading volumes fell to 229 million shares compared with Thursday’s tally of 270 million.

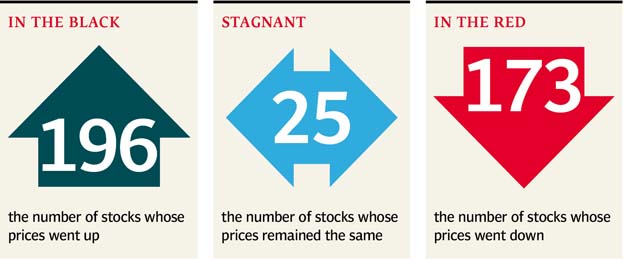

Shares of 394 companies were traded. At the end of the day, 196 stocks closed higher, 173 declined while 25 remained unchanged. The value of shares traded during the day was Rs10.5 billion.

Pakistan International Bulk Terminal was the volume leader with 37.2 million shares, losing Rs1.64 to finish at Rs33.54. It was followed by Engro Polymer with 26.4 million shares, gaining Rs0.67 to close at Rs18.19 and Dost Steels Limited with 12.6 million shares, losing Rs0.33 to close at Rs10.43.

Foreign institutional investors were net sellers of Rs1.02 billion during the trading session, according to data maintained by the National Clearing Company of Pakistan Limited.

Published in The Express Tribune, December 24th, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ