Market watch: Stocks fall as profit-booking continues

Benchmark KSE 100-share Index dips 293.53 points

PHOTO: EXPRESS

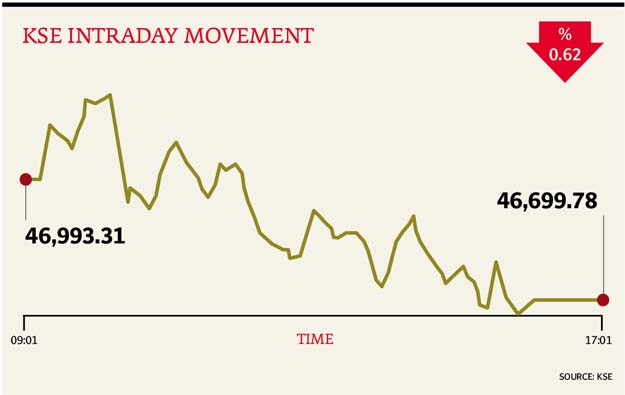

At close, the Pakistan Stock Exchange’s (PSX) benchmark KSE 100-share Index finished with a fall of 0.62% or 293.53 points at 46,699.78.

According to Elixir Securities, the market opened positive helped by select index names that pushed the benchmark index higher over 47,200. However, it couldn’t sustain that level for long and market took the path of steady declines on profit-taking across the board.

“Declines were led by index heavy oils (-1.5%) that bore the brunt of an overnight decline in global crude, followed by index heavy financials (-1.1%) that also remained on the radar of profit-bookers,” said analyst Ali Raza.

“Cements too were down by 0.3%, however Lucky Cement (LUCK PA +0.4%) stood strong and weathered the weakness on value buying,” the analyst commented.

“Activity in wider market was noticeably dull as most institutional investors and day traders stuck to the side-lines; only 270 million shares were traded on KSE All Share Index, down 30% from yesterday,” Raza added.

Meanwhile, JS Global analyst Nabeel Haroon was of the view that volatility prevailed in the market as the index traded between an intraday high of +209 points and intraday low of -328 points to finally close at 46,700 level.

“PSMC (+2.43%) in the automobile sector gained on the back of news that the automobile assembler has introduced Suzuki Vitara in the high end category,” said Haroon.

“NCL (+1.69%) and KTML (+3.09) in the textile sector gained on the back of textile exports numbers released by PBS, which showed YoY growth of 47.8% in Cotton Yarn for the month of Nov-2016. This surge in exports was due to weakening dynamics of Vietnam, as the country is currently suffering from higher material costs due to its increased reliance on imported cotton,” he commented.

“E&P extended its loss as it closed (-1.6%) lower than its previous day close. OGDC (-1.46%) and PPL (-1.67%) were major losers of the aforementioned sector.

“Going forward, we recommend investors to stay cautious and wait for correction in the market to accumulate new positions,” he added.

Trading volumes fell to 270 million shares compared with Wednesday’s tally of 388 million.

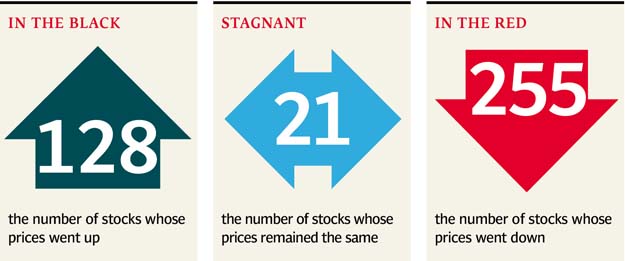

Shares of 404 companies were traded. At the end of the day, 128 stocks closed higher, 255 declined while 21 remained unchanged. The value of shares traded during the day was Rs13 billion.

Pakistan International Bulk Terminal was the volume leader with 35.2 million shares, losing Rs1.85 to finish at Rs35.18. It was followed by Dost Steel Limited with 16.8 million shares, losing Rs0.01 to close at Rs10.76 and Engro Polymer with 15.6 million shares, gaining Rs0.31 to close at Rs17.52.

Foreign institutional investors were net sellers of Rs124 million during the trading session, according to data maintained by the National Clearing Company of Pakistan Limited.

Published in The Express Tribune, December 23rd, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ