Market watch: Index ends with minor correction, 13-session streak snaps

Benchmark KSE 100-share Index falls 216.75 points

PHOTO: EXPRESS

The 13-session streak, the longest since 2005 when the index gained through 15 successive sessions, was brought to an end on account of reports that local institutional buying remained selective, triggering a much-awaited profit-taking session and causing leveraged players to resort to panic selling.

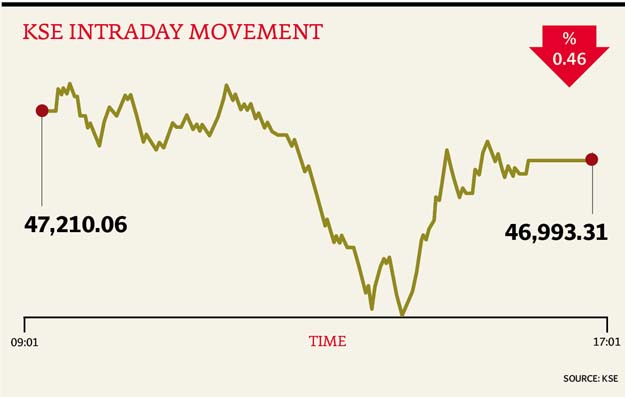

At close on Wednesday, the Pakistan Stock Exchange’s (PSX) benchmark KSE 100-share Index finished with a fall of 0.46% or 216.75 points at 46,993.31.

Elixir Securities, in its report, stated that stocks opened sideways and market struggled to find a clear direction on thin volumes in early trade as local institutional buying reportedly was selective.

“By mid-day, a slow descent turned into a sharp dip as reportedly leveraged players and panic sellers dumped holdings to pull benchmark KSE-100 index to test 46,350,” said analyst Faisal Bilwani.

“Oil stocks somewhat ignored moves in wider market and tracked global crude while financials were the most volatile with Habib Bank (HBL PA -0.2%) hitting lower price limit intra-day, however, value hunters were eager not to miss out and bought at lows, helping cover most of the day’s losses,” the analyst remarked.

“Recent laggard Pakistan State Oil (PSO PA +2.2%) was an outlier with stock trading against market direction to close green on earnings excitement primarily from bets of inventory gains as crude sees recovery.

“Maple Leaf (MLCF PA +4.3%) also traded strong and closed at record high on rumours related to acquisition while Hub Power (HUBC PA -2.5%) corrected after gaining over 9% in last three sessions,” said Bilwani.

“Newsflow from PSX bidding may bring positivity and boost confidence and we expect heightened volatility with benchmark possibly seeing sharp swings intra-day. We continue to advise caution and see strong resistance on upside, value buyers may possibly help limit downside,” he added.

Meanwhile, JS Global analyst Nabeel Haroon was of the view that range bound activity was witnessed at market opening, which was followed by hefty selling as the index lost to make an intraday low of 865 points.

“Recovery was seen in the market during the latter hours, as the index recovered to close at 46,993 level (-217 points). Profit taking was witnessed in the banking sector as the sector closed (-0.83%) lower than its previous day close. UBL (-1.41%) and AKBL (-2.47%) were major losers of the aforementioned sector,” he remarked.

“Despite selling pressure in the market, there was nominal decline in the E&P sector only, as the crude oil prices surged to trade above $53.50/bl level. PPL (-0.62%) in the aforementioned sector declined slightly to close in the red zone,” the analyst commented.

“NCL (+1.15%) gained as numbers released by PBS showed growth in textile export of around 9.71% YoY to $1.05 billion. Cotton yarn export (47.8% YoY) contributed significantly to this export number mainly due to weakening dynamics of Vietnam, as the country is currently suffering from higher material costs due to its reliance on imported cotton.

“Going forward, we recommend investors to stay cautious and see any upside in prices as an opportunity to sell,” Haroon added.

Trading volumes fell to 388 million shares compared with Tuesday’s tally of 450 million.

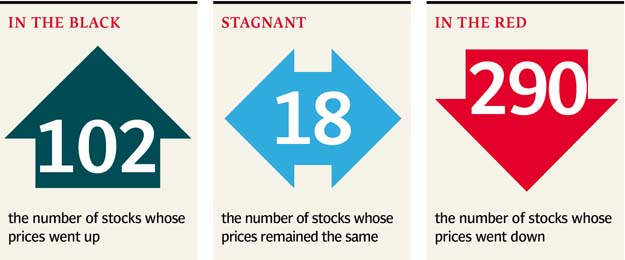

Shares of 410 companies were traded. At the end of the day, 102 stocks closed higher, 290 declined while 18 remained unchanged. The value of shares traded during the day was Rs21.4 billion.

Dost Steel Limited was the volume leader with 31.1 million shares, losing Rs0.79 to finish at Rs10.77. It was followed by Bank of Punjab with 22.6 million shares, losing Rs0.76 to close at Rs17.32 and K-Electric with 14.2 million shares, losing Rs0.10 to close at Rs9.28.

Foreign institutional investors were net sellers of Rs1.2 billion during the trading session, according to data maintained by the National Clearing Company of Pakistan Limited.

Published in The Express Tribune, December 22nd, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ