Value of large transactions through RTGS reaches Rs232tr

Payment systems showed significant growth in key indicators during fiscal year 2016

Value of large transactions through RTGS reaches Rs232tr

Though the volume of paper based transactions have decreased by 6% during the year, they still constitute approximately 38% of volume of total retail payments.

Foreign exchange: SBP’s reserves decrease to $18.41b

The central bank said that payment systems in Pakistan have shown significant growth in key performance indicators during fiscal year 2016.

“It is encouraging to witness consistent upward trend in volume and value of payments through digital/electronic channels which complement the SBP’s vision to promote digital payments in the country,” according to a press release. On the other hand, the use of e-banking channels has shown bullish trends as evident from increase of e-banking transactions by 16% in volume and 4% in value.

Likewise, real-time online banking transactions also rose 135.4 million by volume and Rs32.3 trillion by value showing an increase of 19% in volume and 2% in value of e-banking transactions during the period under review.

The use of Alternate Delivery Channels (ADCs) such as ATMs, point of sale (POS) terminals, internet and mobile banking also showed rising trend as of June 2016 as 39.2 million transactions valuing approximately Rs200 billion were carried out at POS terminals compared with 32.1 million transactions valuing Rs172 billion, up 22% in volume and 16% in value compared with the previous year. Likewise, internet and mobile banking also showed steady growth.

Appreciation: Businessmen hail low interest rate

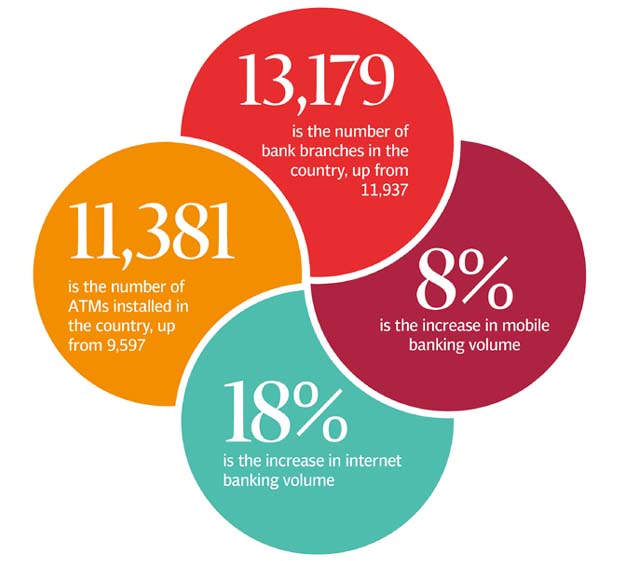

Internet banking rose to 18% in volume and 10% in value whereas mobile banking showed an increase of 8% in volume and 5% in value during the period under review.

Payment system infrastructure also showed phenomenal growth during the period under review. The number of branches increased from 11,937 to 13,179 whereas total number of ATMs installed in the country increased from 9,597 to 11,381 during the year.

On the other hand, 9,586 POS terminals were added to the network totaling 50,769 POS terminals as on June 30, 2016. Going forward, SBP is working on a two pronged strategy for effectively enabling the adoption of electronic/digital payments by the general public in Pakistan.

Firstly, the expansion of infrastructure at three different levels: instruments (like cards and wallets), access points (like ATMs, POSs, and mobile devices) and central payment processers (like switches and gateways).

Secondly, the strengthening of regulatory and oversight frameworks for ensuring the safety and soundness of these payment infrastructures which, in turn, will enhance the trust and confidence of ordinary consumers on these alternate payment methods.

Published in The Express Tribune, December 18th, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1733130350-0/Untitled-design-(76)1733130350-0-208x130.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ