At close on Thursday, the Pakistan Stock Exchange’s benchmark KSE 100-share Index finished with a rise of 0.37% or 173.08 points to finish at 46,358.35 - its highest finish yet.

Elixir Securities, in its report, stated that despite the negative lead from regional equity markets following rate hike decision by US Federal Reserves and lower global crude, market maintained its positive run helped by strong local liquidity in blue chip names that pushed benchmark KSE-100 index above the 46,300 level.

“Early support came from select financials, while exploration and production (E&Ps) also supported the gains after bouncing back near mid-day following mild recovery in global crude,” said analyst Ali Raza.

“Textiles too came under limelight and traded higher over news of reduction in gas prices for textile manufacturers; Nishat Mills (NML PA +5%), Gul Ahmed Textile Mills (GATM +5%), Nishat Chunnian (NCL PA +3.7%),” remarked Raza.

“In autos, Pak Suzuki Motors (PSMC PA +5%) emerged as a top gainer as the company unveiled its plans to invest $460 million in a new plant.

“On the other hand, cement and fertiliser witnessed profit-taking with Lucky Cement (LUCK PA -3%) and Engro Corp (ENGRO PA -0.8%) dented the KSE-100 index,” said Raza.

“We advise caution at current levels as correction in market appears imminent given market has rallied sharply by over 8% in ten straight trading sessions,” he added.

Meanwhile, JS Global analyst Nabeel Haroon was of the view that market extended its previous day gains as it gained around 173 points to close at a new high of 46,358.

“Most of the intraday gains were lost as investors preferred to book their profits in line with the bearish trend in the international markets after the US Federal Reserve increased its interest rates by 25 basis points in its review yesterday,” Haroon commented.

“Investor interest was seen in the textile sector as dollar gained against Pak rupee in the currency market.

“Automobile sector gained on the back of decline in Yen, as the sector gained to close 1.1% higher from its previous day close. PSMC (+5%) and HCAR (+1.46%) were major gainers of the aforementioned sector,” said the analyst.

“Intraday day rally was witnessed in the E&P sector on the back of surge in crude oil prices during the day, as it gained to trade above $51/bbl level. PPL (+1.23%) and OGDC (+0.99%) were major index movers from the aforementioned sector.

“Moving forward we recommend investors to stay cautious at current levels, as correction in the market is long overdue,” he added.

Trading volumes fell to 340.4 million shares compared with Wednesday’s tally of 360.7 million.

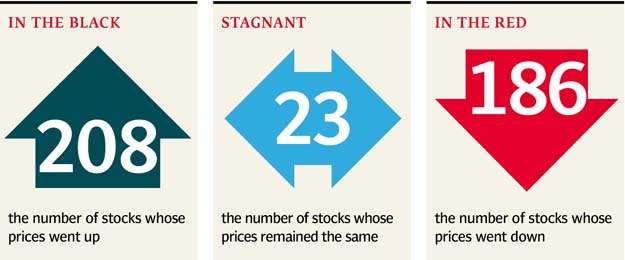

Shares of 417 companies were traded. At the end of the day, 208 stocks closed higher, 186 declined while 23 remained unchanged. The value of shares traded during the day was Rs19.3 billion.

Aisha Steel Mill was the volume leader with 19.7 million shares, gaining Rs0.09 to finish at Rs16.50. It was followed by TRG Pakistan Limited with 15 million shares, losing Rs0.77 to close at Rs44.85 and Engro Polymer with 14 million shares, gaining Rs0.91 to close at Rs16.03.

Foreign institutional investors were net sellers of Rs503 million during the trading session, according to data maintained by the National Clearing Company of Pakistan Limited.

Published in The Express Tribune, December 16th, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1732256278-0/ellen-(1)1732256278-0-165x106.webp)

1725877703-0/Tribune-Pic-(5)1725877703-0-165x106.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ