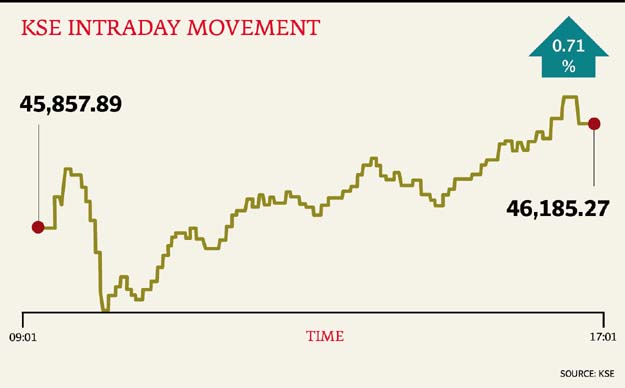

Market watch: Index powers past 46,000, positive run in December continues

Benchmark KSE 100-share Index rises 0.71%

Benchmark KSE

100-share Index rises 0.71%

The bull run has seen the index gain 8.4% since November 30 - the last day it ended negative - and has contributed to an already phenomenal year for the Pakistan Stock Exchange.

At close on Wednesday, the PSX’s benchmark KSE 100-share Index finished with a rise of 0.71% or 327.38 points to finish at 46,185.27.

Elixir Securities analyst Faisal Bilwani said Pakistan equities shunned all calls for a breather to close above key psychological level of 46,000 primarily on gains in oil and select index names.

“A positive open was followed by intraday correction where wider market slipped in red and KSE100 index tested support near 45,600,” said Bilwani.

“However, institutional buying soon overtook and swayed the momentum back mainly led by index heavy exploration and production (E&Ps).

“Pakistan Petroleum (+5%) and Pakistan Oilfields (+5%) emerged as top gainers with former grabbing investor attention over positive news of Sui lease extension and improved pricing that helped sentiments while latter hit second consecutive upper price limit.

“Oil & Gas Development Company (OGDC,+1% ) also ended the day green as battle between aggressive foreign sellers and local smart money continues with stock trading over 10 million shares on the day.

“Hub Power (HUBC, +2.5%) closed another positive day after recent update on progress over coal fired power plant while cements were higher on reported institutional buying.

“Autos on the other hand unperformed market after lower than expected monthly sales numbers,” said Bilwani.

JS Global analyst Nabeel Haroon said volatility prevailed but the index finally close at its new high of 46,185 (+327 points).

“E&P sector was the major index mover, as it extended its previous day gains to close 2.8% higher.” This gain was on the back of crude oil prices as they traded comfortably above $52/bbl, on the back of major oil producing countries’ decision to limit their production going forward in their meeting in Vienna last weekend, said Haroon.

“Intraday rally was witnessed in cements as the sector gained to close 0.7% higher than its previous day close. Maple Leaf Cement (+4.33%) and DG Khan Cement (+2.26%) were top performers.”

Trading volumes rose to 360.7 million shares compared with Tuesday’s tally of 383 million.

Shares of 412 companies were traded. At the end of the day, 171 stocks closed higher, 226 declined while 15 remained unchanged. The value of shares traded during the day was Rs18.9 billion.

Dolman City Reit was the volume leader with 30.7 million shares, gaining Rs0.05 to finish at Rs11.00. It was followed by TRG Pakistan Limited with 29.6 million shares, gaining Rs2.15 to close at Rs45.62 and Bank of Punjab with 17.1 million shares, gaining Rs0.17 to close at Rs17.04.

Foreign institutional investors were net sellers of Rs1.1 billion during the trading session, according to data maintained by the National Clearing Company of Pakistan Limited.

Published in The Express Tribune, December 15th, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ