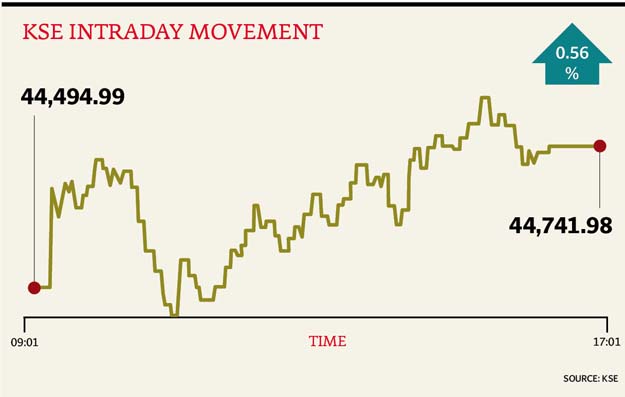

market watch: Index gains for sixth consecutive session

Benchmark KSE 100-share Index rises 246.99 points

Benchmark KSE 100-share Index rises 295.59 points

At close, the Pakistan Stock Exchange’s benchmark KSE 100-share Index finished with a rise of 0.56% or 246.99 points to finish at 44,741.98 - its highest finish yet.

Elixir Securities, in its report, stated that market traded directionless in early hours but activity picked up near mid-day on selective institutional interest that helped steady gains with index testing new all-time high over 44,800 level.

“Major contribution to day’s gains came from Lucky Cements (LUCK PA +5%) that emerged as a star performer after the company notified exchange of a proposed equity investment for JV with Korean Auto maker, KIA Motors, and doubling of its grinding capacity in Iraq,” said analyst Faisal Bilwani.

“Select financials also ended the day green with Habib Bank (HBL +1.5%) and United Bank (UBL PA +2.1%) trading higher on reported local buying, while MCB Bank (MCB PA -0.1%) closed little changed following over 8% gains this month alone on news of NIB Bank acquisition.

“Volumes on KSE100 index were lower by 44% vs yesterday while activity was focused in small and mid-cap plays that dominated volumes chart on retail interest,” said Bilwani.

“With market reaching its critical resistance level of 44,800 level and possible holiday mood ahead of long weekend, we see lacklustre activity and range bound trading while developments on political front and noise surrounding First Family’s court case will remain a dampener and may trigger an across-the-board profit taking with support near 44,000,” he added.

JS Global analyst Nabeel Haroon remarked that the market continued its positive momentum.

“LUCK gained to close on its upper circuit as the board of directors of the company in their meeting have authorised an investment of Rs12 billion to set up a company to assemble and market KIA motor vehicles in Pakistan. They further resolved to start due diligence of North plant of Dewan Cement Limited located in Hattar, District Haripur,” said Haroon.

“NPL gained for the second consecutive day on the back of news that Nishat Power Limited along with its co-sponsor TBEA Xinjiang Sun Oasis Company Limited from China will use Nishat Energy Limited (NEL), as a special purpose vehicle to set up a 1x660 MW coal fired power plant at Liaqatpur Tehsil in Rahim Yar Khan,” said the analyst.

“OGDC (+0.53%) and PPL (+0.95%) in the E&P sector gained to close in the green zone on the back of slight rebound in crude oil prices, as it gained to trade above US$50/bbl level.

“Moving forward, we recommend investor book profits at current levels,” he added.

Trading volumes fell to 368 million shares compared with Wednesday’s tally of 470 million.

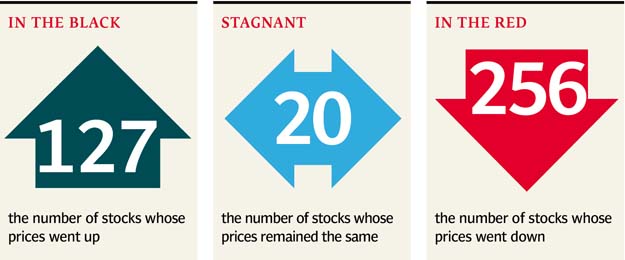

Shares of 403 companies were traded. At the end of the day, 127 stocks closed higher, 256 declined while 20 remained unchanged. The value of shares traded during the day was Rs15.8 billion.

Bank of Punjab was the volume leader with 52.8 million shares, losing Rs0.58 to finish at Rs17.18. It was followed by NIB Bank Limited with 48.1 million shares, losing Rs0.38 to close at Rs1.71 and Aisha Steel Mill with 31.3 million shares, gaining Rs0.80 to close at Rs15.47.

Foreign institutional investors were net sellers of Rs204 million during the trading session, according to data maintained by the National Clearing Company of Pakistan Limited.

Published in The Express Tribune, December 9th, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ