Similarly, the central bank’s decision to keep the policy rate stagnant resulted in lacklustre activity in bank shares. Overall, the investors remained cautious with lower gas prices sparking a bit of optimism.

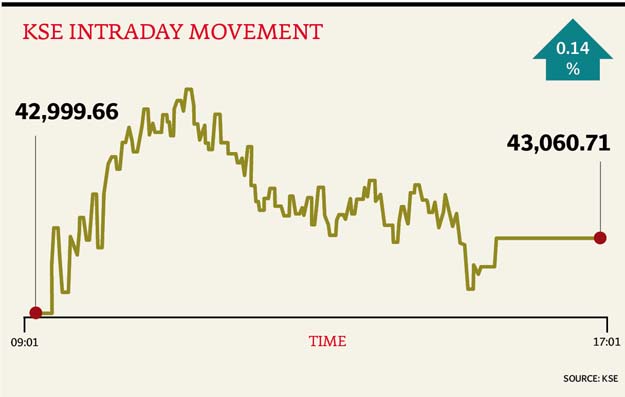

At close, the Pakistan Stock Exchange’s benchmark KSE 100-share Index recorded a rise of 0.14% or 61.05 points at 43,060.71.

According to Elixir Securities analyst Ali Raza, the equities closed first day of the week marginally positive after volatile trading.

“Friday’s news of gas price reduction helped morning gains with most industrial stocks along with cement shares gaining. However, late selling on reported institutional profit-taking wiped off most of the gains.”

“Engro Corp (+2.2%) along with Dawood Hercules (+1.6%) were positive as Engro Foods’ (+2.1%) public tender offer dates were announced to complete the sale to FrieslandCampina Pakistan.

“Oil stocks traded against market direction and closed in the red as investors tracked losses in global crude over the weekend. As expected and in line with the recent trend, volumes were led by small-cap penny names and mid-caps and interestingly, volumes on the KSE-100 index were the lowest since early September with cautious local activity and limited foreigner participation.

“The KSE-100 in our view will likely hover near 43k and we see volatility to continue with flows guiding index names while small-caps may see selective profit taking in the days ahead.”

JS Global analyst Nabeel Haroon said the market continued its positive momentum during the initial hours of trading but soon investors opted for profit-taking.

“The steel sector closed in the green zone, where Amreli Steel closed at Rs75.98 (+4.84%) on the back of news that the NTC initiated an anti-dumping investigation into imports of deformed steel concrete and reinforcing bars originating in and/or exported from China.”

Moving further, mixed sentiments were witnessed in the cement sector. Top gainers of the sector were Bestway Cement (+2.99%) and DG Khan Cement (+1.33%).

“The banking sector remained lacklustre as the State Bank of Pakistan kept its policy rate unchanged at 5.75%,” he said.

“Exploration and production sector closed in the red zone as oil prices retraced losses on the back of concerns that the upcoming OPEC meeting may not conclude with an agreement on output cuts. Going forward, for the local market we recommend investors to remain cautious.”

Trade volumes fell to 460 million shares compared with Friday’s tally of 502 million.

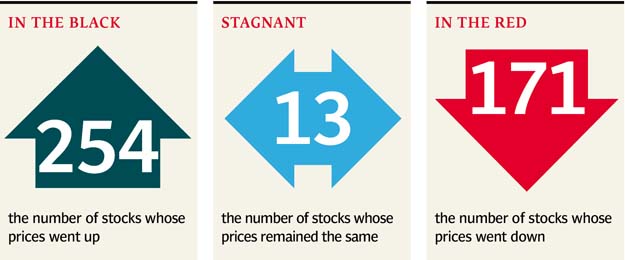

Shares of 438 companies were traded. At the end of the day, 254 stocks closed higher, 171 declined while 13 remained unchanged. The value of shares traded during the day was Rs13.3 billion.

Lotte Chemical was the volume leader with 30.1 million shares, gaining Rs0.73 to finish at Rs9.04. It was followed by Media Times with 28.3 million shares, gaining Rs0.75 to close at Rs6.15 and Nimir Resins with 15.7 million shares, gaining Rs0.83 to close at Rs13.65.

Foreign institutional investors were net sellers of Rs170 million during the trading session, according to data maintained by the National Clearing Company of Pakistan Limited.

Published in The Express Tribune, November 29th, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1732794933-0/Express-Tribune-(1)1732794933-0-270x192.webp)

1732084432-0/Untitled-design-(63)1732084432-0-270x192.webp)

1732789727-0/BeFunk_§_]__-(68)1732789727-0.jpg)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ