The international crude oil prices bounced back due to news of possible agreement among OPEC members, which pushed up the exploration and production (E&P) sector at the bourse.

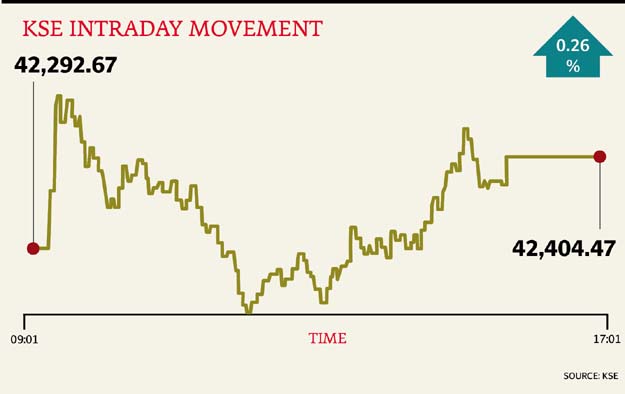

At close on Wednesday, the Pakistan Stock Exchange’s benchmark KSE 100-share Index recorded a gain of 0.26% or 111.80 points to end at 42,404.47.

According to Elixir Securities analyst Ali Raza, equities traded listlessly for most part of the day swinging between gains and losses. However, selective value buying in late afternoon helped the benchmark index to close positive.

“The wider market traded positive at the open as index-heavy exploration and production sector contributed to the gains over higher global crude oil price.

“However, other major sectors including financial, cement and fertiliser struggled to find a clear direction and saw lacklustre trading, with limited activity primarily from local institutional investors amid ambiguity over the direction of foreign flows.”

Retail investors were not much aggressive either, as evident from lower volumes in small and mid-caps, as they too chose to hold back significant investments over lack of clarity on market direction and domestic politics as the Supreme Court was hearing the case against PM Nawaz Sharif’s family over corruption allegations.

“Expect volatile and choppy trading again tomorrow (Thursday) with investors, especially local institutions, trading selectively, track foreign funds activity and keenly follow developments on the domestic political front.”

Meanwhile, JS Global analyst Nabeel Haroon said that volatility prevailed in the market as the index traded between an intraday high of +188 points and intraday low of -79.

“Hascol in the OMC sector gained to close on its upper circuit on the back of material information disseminated in the market that Vitol Dubai Limited has acquired an additional 10% shares of Hascol Petroleum by exercising their call option taking their total shareholding to 25%.

“Meezan Bank (MEBL +2.33%) in the banking sector gained on the back of news that the State Bank of Pakistan (SBP) has announced a reduction in Statutory Liquidity Requirement (SLR) for Islamic banks by 5% to fix it at 14%. This move by SBP came in to facilitate Islamic banking industry as Rs225bn of Bai-Muajjal is maturing tomorrow and after this maturity SLR of most Islamic banks and Islamic windows of conventional banks will fall short of the previously required 19%.”

Trade volumes rose to 386 million shares compared with Tuesday’s tally of 366 million.

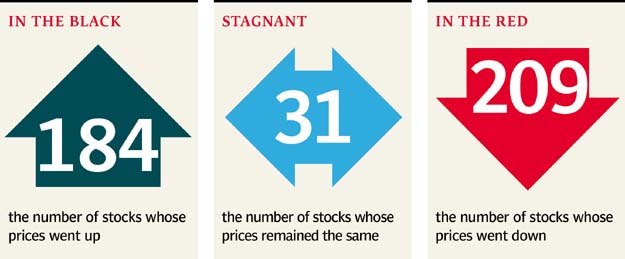

Shares of 424 companies were traded. At the end of the day, 184 stocks closed higher, 209 declined while 31 remained unchanged. The value of shares traded during the day was Rs13.1 billion.

WorldCall Telecom was the volume leader with 37.2 million shares, gaining Rs0.18 to finish at Rs2.96. It was followed by Japan Power with 29.4 million shares, losing Rs0.17 to close at Rs6.52 and Bank of Punjab with 22.9 million shares, losing Rs0.14 to close at Rs19.72.

Foreign institutional investors were net sellers of Rs389 million during the trading session, according to data maintained by the National Clearing Company of Pakistan Limited.

Published in The Express Tribune, November 17th, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1724657897-0/Untitled-design-(2)1724657897-0-405x300.webp)

1731884290-0/image-(9)1731884290-0-270x192.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ