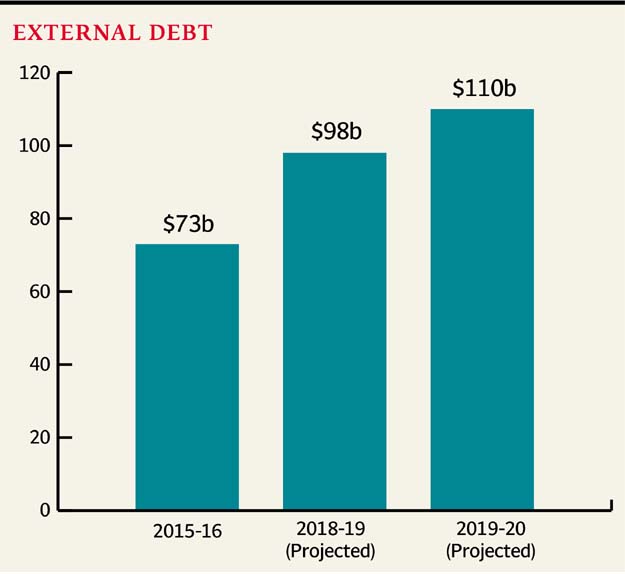

Pakistan’s external debt likely to swell to $110b in four years

Country may return to the IMF as it will need $22 billion for external payments in FY20

PHOTO: AFP

By that time, Pakistan will again be back to the International Monetary Fund (IMF) to avoid default on international payments as it did in 2013, according to independent projections revealed at the National Debt Conference on Saturday.

Circular debt in power sector: Govt could not repay bank loans of Rs136.5b

Two renowned economists, former finance minister Dr Hafiz Pasha and former director general debt Dr Ashfaque Hasan Khan, have made the external debt projections. The $110-billion external debt level by 2019-20 will be $24 billion higher than projections made by the IMF in its latest report on Pakistan.

Khan shared his assessment at the debt conference, arranged by the Policy Research Institute of Market Economy (PRIME) - an independent think tank.

The duo updated their previous external debt forecast for fiscal year 2018-19 from $90 billion to $98 billion after the government borrowed heavily in the past one year.

At present, the external debt stands at $73 billion, which has been projected to swell 50% to $110 billion in just four years.

They did not see a major change in Pakistan’s export situation and anticipated that by 2019-20, the exports would stand roughly at $25 billion, a level that the country crossed in the last year of previous government of Pakistan Peoples Party (PPP).

Owing to slowdown in exports, Pakistan’s external debt to export ratio has been projected at 441.8% by 2019-20, which is highly unsustainable. By that year, the country will consume 40% of its export earnings to service the external debt.

“Pakistan is fast slipping into the debt trap and neither the government nor parliament is playing its due role,” remarked Asad Umar, MNA of Pakistan Tehreek-e-Insaf while speaking at the conference.

Khan said by 2019-20 amortisation payments would increase to $10 billion. To fill the current account gap, the country will require another $12.5 billion a year, increasing the total external payment requirement to $22.5 billion. The current account deficit will mainly widen due to imports of machinery and plants for projects being developed under the China-Pakistan Economic Corridor (CPEC).

Against IMF’s projection of $16.7 billion, Khan said total external financing needs to bridge the current account deficit and repay loans would stand at $22.5 billion by 2019-20.

After exhausting all available resources including CPEC financing, foreign investment and funds from traditional donors, there would still be $11-billion financing gap, which the country would not be able to bridge without IMF’s help, said Khan.

He predicted that Pakistan would return to the IMF in 2018-19 - the fiscal year when the country’s external debt would be $98 billion and its financing gap will be $9 billion.

“Pakistan’s debt situation is deteriorating rapidly and posing a serious threat to its solvency,” he cautioned. Commercial borrowings comprised 25% of external debt, which was a matter of concern, said Shahid Kardar, former governor of the State Bank of Pakistan.

He said low returns on the country’s foreign currency reserves compared to the borrowing cost were also a matter of concern.

Khan said the PML-N and PPP governments had added $49 billion to the current external debt of $73 billion. Most of this amount, estimated at $32.6 billion, was added from 2008 to 2016 while the remaining $17.4 billion was added during the 1990s.

Pakistan’s trade deficit widens 22%, stands at $9.3 billion

“We need to develop a more effective borrowing strategy, which should be consistent with the country’s development priorities,” suggested Khan.

“Pakistan can keep its debt at sustainable levels by achieving about 6% annual economic growth,” said Dr Ali Kemal, research economist at the Pakistan Institute of Development Economics (PIDE). He, however, said despite the increase in debt levels, Pakistan was still not Greece.

“We are at a comfortable stage and there is no need to worry about anything,” said Zafar Masud, Director General of the Central Directorate of National Savings, while speaking at the conference.

Published in The Express Tribune, November 13th, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ