A subcommittee of the National Assembly Standing Committee on Finance formalised its recommendations after holding discussions with representatives of the real estate sector. Before holding the meeting, committee members took the input of Finance Minister Ishaq Dar and Special Assistant to Prime Minister on Revenue Haroon Akhtar Khan.

Realty business: Yet another amnesty scheme in the offing

An amnesty would be offered at the rate of 3%, said Mian Abdul Manan, a member of the sub-committee, at the conclusion of the meeting. He said that the finance minister and special assistant to PM on revenue were also on board on the issue.

The subcommittee had been constituted with the sole purpose of getting the parliament’s stamp of approval for the amnesty scheme, as this time the government is not in the mood to take full responsibility.

The four-member committee met under the convener Saeed Ahmad Khan, PML-N MNA. Out of four, three members are from the ruling party while one, Rashid Ahmad Godil, belongs to the MQM. The subcommittee does not have representation of the PPP and PTI - the main opposition parties in the National Assembly.

Realty sector saga

The need for the amnesty arose after the government introduced amendments in the Income Tax Ordinance with effect from July 1, aimed at collecting taxes on property transactions at fair market values. However, within a month, the government retreated and implemented compromised property valuation rates by promulgating a Presidential Ordinance on July 31 with consensus of property dealers.

Now, the realty sector is not even ready to pay taxes on the rates they have already agreed on. They are now demanding that these rates be lowered and the government should also give a tax amnesty so they may declare their hidden assets.

The upcoming amnesty is also the result of fierce lobbying by ruling party legislators and property dealers who claim that the market has sunk due to new valuation tables of property prices in major cities of the country.

Real estate set to win biggest tax amnesty

The likes of Pervez Malik, the ruling party MNA from Lahore, and Khawaja Saad Rafique, Minister for Railways, and others urged the prime minister to give a comprehensive amnesty scheme this time.

Latest scheme

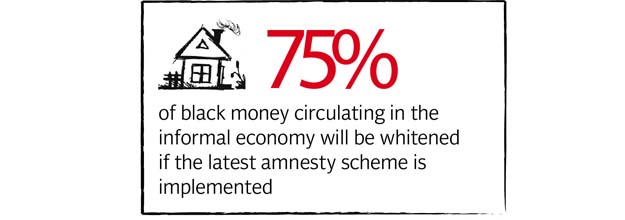

The latest amnesty scheme - the fourth in last three years - will whiten about 75% of black money circulating in the informal economy after the previous deal with the realty sector, struck in July, could not fully address the sector’s problems, according to tax experts.

The property dealers want that the amnesty should be given at 1% - a demand fiercely opposed by Dr Mohammad Iqbal, the FBR’s representative. Iqbal said that the standard income tax rate is up to 35%.

The amnesty scheme will discourage those who are forced to pay taxes at the standard rates, mainly the salaried class.

At present, taxes on property transactions are determined through the DC rates at the provincial level while federal taxes are paid on the basis of FBR-notified property rates. The dealers are declaring two prices - one for provincial taxes and the second for federal taxes.

However, the actual property rates are far higher than the FBR rates - a fact that the parliamentarians and realty sector representatives also admitted on Tuesday.

Mian Manan said that the government will try to implement the amnesty scheme within a month and in order to fast track its approval a joint meeting of the National Assembly and Senate Standing Committees on Finance may be called.

The tax amnesty package will be presented in the National Assembly during the forthcoming session, said Mian Manan. To give effect to the amnesty, fresh amendments will be proposed in the final draft of the already under discussion “Income Tax (Amendment) Ordinance-2016” that the government presented in the lower house of parliament a couple of months ago to provide permanent legal cover to a deal that it struck with the realty sector in July this year.

Saeed Ahmad Khan said that the subcommittee may meet for another time to propose amendments in the relevant clauses.

Published in The Express Tribune, November 9th, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1732569774-0/Baymax-(2)1732569774-0-165x106.webp)

COMMENTS (8)

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ