Uber under pressure in Pakistan as Careem speeds ahead

Careem asserts that its local operations have grown at an average rate of 50 per cent month-on-month

Uber faces tough competition in Pakistan through the presence of Careem. Photo credit: Publicity

Uber says Pakistan is one of its fastest growing global markets and Careem asserts that its local operations have grown at an average rate of 50 per cent month-on-month.

Such figures aren’t hard to believe in a country of 200 million people with abysmal public transport options. Both startups solve a very real problem – hence the fast rate of adoption. Uber drivers are being forced to stay on the road for up to 18 hours a day. But both Uber and Careem have so far been wary to venture out of the large urban centres of Karachi, Lahore, and Islamabad. Uber, in fact, doesn’t even operate in the capital city and hasn’t given a timeline when it plans to do so.

Careem introduces peak time pricing in Karachi

This might be about to change.

PHOTO: CAREEM

PHOTO: CAREEMCareem today announced that it’s searching for general managers in the cities of Hyderabad, Faisalabad, Gujranwala, Peshawar, and Multan. According to figures from the last census, which was conducted in 1998, the combined population of the cities is over 6.5 million.

Junaid Iqbal, CEO of Careem Pakistan, tells Tech in Asia that the cities have been chosen on the basis of population, income levels, and constant requests from the areas for launch. The plan is to bring these cities online in a matter of weeks, with growth expected to be “exponential.”

Teething issues

In an effort to gain market share, both Uber and Careem have been vigorously trying to lock in as many drivers as possible. Uber says it has over 1,000 active drivers in the city of Lahore, with many more joining the platform daily. But all’s not well with the global behemoth.

Local media reports have claimed the bulk of those profiting from Uber’s entry into Pakistan have been large fleet owners. They’ve put their idle cars on Uber, and, in some cases, forced drivers to stay on the road for up to 18 hours every day. In return they’re given a set wage of only US$250/month, with little incentive to maintain high service levels.

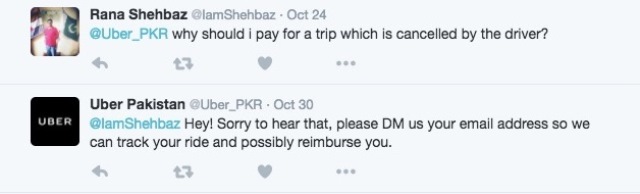

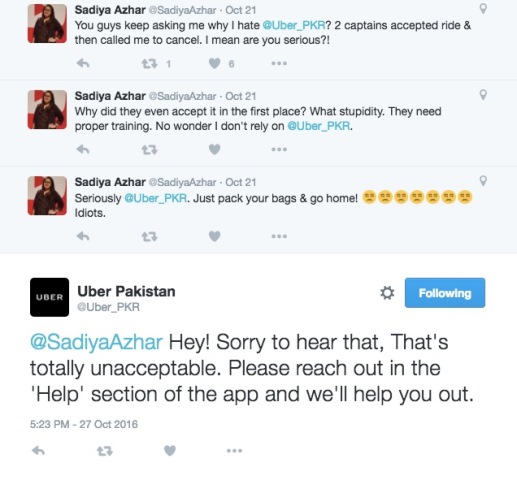

Customer complaints on Uber’s Twitter page have been left unattended for several days and alarming stories of harassment have also emerged. Uber seems to be maintaining a hands-off approach in Pakistan, preferring to weed out drivers through its ratings mechanism, rather than working with them closely to raise standards.

The tactic stands in stark contrast to the one adopted by Careem, where Junaid says there’s a lot of “hand-holding,” to help drivers, whom it refers to as “captains,” be experts at customer service and keep them happy at the same time.

“Managing this balance is a tough job,” he asserts.

Uber launches rickshaw service in Pakistan

Word on the street is that Careem is comfortably beating Uber, both in terms of active riders as well as cars plying the roads. The view is consistent with data from SimilarWeb, which says Careem is the larger company in Pakistan based on app installs.

Uber is priced anywhere between 25 to 30 per cent cheaper than Careem. If the Middle Eastern challenger is indeed ahead, it shows that Pakistan’s commuters want a premium experience and aren’t hesitant about paying slightly more for it.

This article originally appeared on Tech in Asia.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ