Growing liability: Govt piles on further debt of Rs858b from July to Sept

Pakistan’s total liabilities increase to Rs19.9tr; domestic debt stands at Rs14.4tr

Pakistan’s total liabilities increase to Rs19.9tr; domestic debt stands at Rs14.4tr. PHOTO: EXPRESS

With an addition of Rs858 billion during the first quarter (July-September) of this fiscal year, the total central government debt, excluding liabilities, increased to Rs19.9 trillion, according to the State Bank of Pakistan (SBP). Of this amount, the domestic debt stood at Rs14.4 trillion while external debt was Rs5.5 trillion. Almost the entire increase came in the shape of domestic debt.

During the past three years, the PML-N government has been subject to severe criticism for acquiring expensive foreign debt and increasing the overall debt mountain. Finance Minister Ishaq Dar has repeatedly said that the central government’s credit was increasing equivalent to budget deficit requirements.

However, the increase in central government’s debt from July through September this year was far more than the budget deficit in the same period. The overall budget deficit - the gap between income and expenditures - stood at roughly 1.35% of Gross Domestic Product or about Rs450 billion during the July-September quarter of this fiscal year.

Even Rs450 billion budget deficit was far higher than the first quarter target of Rs325 billion after the government’s tax and non-tax revenues massively fell short of target.

Structural changes

The central bank data further revealed structural changes that took place in the country’s debt profile during the first quarter, although finance ministry officials said that these were temporary in nature. The SBP data showed that the share of long-term permanent debt in the total domestic debt was significantly reduced, which may heighten risks attached with rollover of maturing loans.

The share of government-backed bonds in its total domestic debt has decreased from 38.8% in June 2016 to just 31.4% in September this year. This means frequent borrowings and more dependence on commercial banks to meet financing needs.

Due to the alarming increase in debt, more than one-third of the total budget is spent on servicing domestic debt, reducing space for spending on development and social sector.

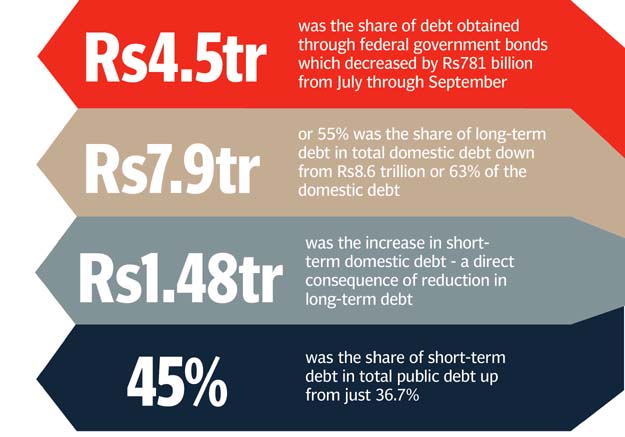

From July through September, the share of the debt obtained through federal government bonds decreased by Rs781 billion to Rs4.5 trillion, according to the central bank. Similarly, the long-term debt share in total domestic debt declined from Rs8.6 trillion or 63% of the domestic debt to Rs7.9 trillion or 55%.

Contrary to this trend, there was an increase of Rs1.48 trillion in the short-term domestic debt, a direct consequence of reduction in long-term debt. The share of short-term debt into total public debt increased from just 36.7% to 45%, showed the central bank data.

But finance ministry officials said that a temporary change in structure was because of maturing of Rs1.3 trillion long-term Pakistan Investment Bonds during the first quarter. They said that the government borrowed Rs2.186 trillion by issuing PIBs and Ijara Sukuk from January 2015 to September 2016 in an anticipation of maturing PIBs.

Reasons for borrowing

The other reason for increase in the short-term borrowings was fresh budget financing needs after the Federal Board of Revenue failed to increase its revenues.

Dar had chaired a meeting this week to review the overall debt profile of the country. However, contrary to these serious developments, a finance ministry handout painted a rather rosy picture.

“Finance Secretary and DG Debt Office briefed the finance minister highlighting that debt sustainability has improved during the present government’s tenure,” according to the official handout. It added the overall borrowing rate has shown a decrease due to macroeconomic stability. The finance minister appreciated the efforts of the Debt Policy Coordination Office.

In its last report, the International Monetary Fund said Pakistan’s fiscal deficit declined significantly although public debt remained high. For a developing country like Pakistan, 50% debt-to-GDP ratio is considered sustainable.

Published in The Express Tribune, November 6th, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ