Shop online now, pay later. No credit cards needed with this startup

Rely aims to tap the rapidly growing ecommerce market

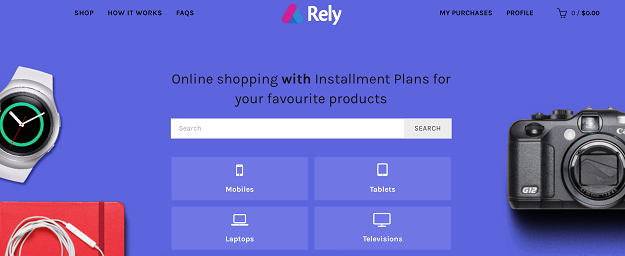

Rely aims to tap the rapidly growing ecommerce market. PHOTO: REUTERS

Rely allows individuals who do not meet minimum income requirements for credit cards to buy items via installment plans.

The eighteen-month-old startup has nabbed a major online retailer as one of its first partners for Rely. It also has plans to enter the Indonesian market next March.

Responding to needs

“What we are doing [through Rely] is to help this group of under-served people to afford products that they really need in their life,” said Mohamed Abbas, 25, co-founder of Onelyst.

Two Pakistani ventures to participate in Oslo Startup Challenge

Abbas, who recently made it to Forbes’ 30 Under 30 list in Asia, adds: “Through analyzing our database, we understood that there is a huge segment of people who have stable incomes and good repayment ability, but do not have credit options.”

PHOTO: ONELYST

PHOTO: ONELYSTWhile Rely is the first platform of its kind in Singapore, there are other similar offerings elsewhere. In the US, for instance, FuturePay and GetFinancing both give online shoppers the option to shop at participating retailers on credit.

How does it work?

Rely will start off as a mobile-friendly website focusing on consumer electronics. Its goal: growing into a mobile application offering a wider range of products.

The platform’s users will be able to choose products, from handphones to tablets, offered by partner retailers, before requesting to buy the items on credit.

The startup then uses its internal score, developed through deep data analytics and analysis of non-traditional data points across users’ digital footprint, to complete its credit approval.

Once approved, the buyer will receive the merchandise, and repay through installments.

Future in a growing market

Rely aims to tap the rapidly growing ecommerce market in Singapore, which was valued at US$1 billion last year. According to a recent joint report by Temasek Holdings and Google, Singapore’s ecommerce market is expected to be worth US$5.4 billion by 2025.

The platform will also headline the startup’s first foray outside Singapore into the Indonesian market in March next year. The startup is already in discussions with lending partners and consumers in the region.

“In terms of digital penetration, Indonesia is huge, with 88 million active Internet users at the moment, and this number is growing,” said Abbas. “The credit card penetration rate there is only about six percent, so Rely will be very helpful for those without credit cards.”

Apple buys its first Indian startup

The startup will soon conduct its pre-Series A round funding to finance its product development and expansion plan but has declined to reveal the figure it is looking for. It previously closed an undisclosed seed round in 2014 with seed capital firm Spaze Ventures.

Abbas hopes all these will come together in fulfilling his startup’s aim of accelerating financial inclusion in Southeast Asia.

“Financial inclusion is correlated with higher living standards, better health, better education, and an overall improvement in well-being,” he said. “Proper access to credit can completely change someone’s life, such as through starting a business or sending their children to school.”

“Responsible spenders should be given access to affordable credit.”

This article originally appeared on Tech in Asia.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ