Weekly review: Index climbs 1.6% as bullish run continues

Finishes at 41,200 as banks and cements shine

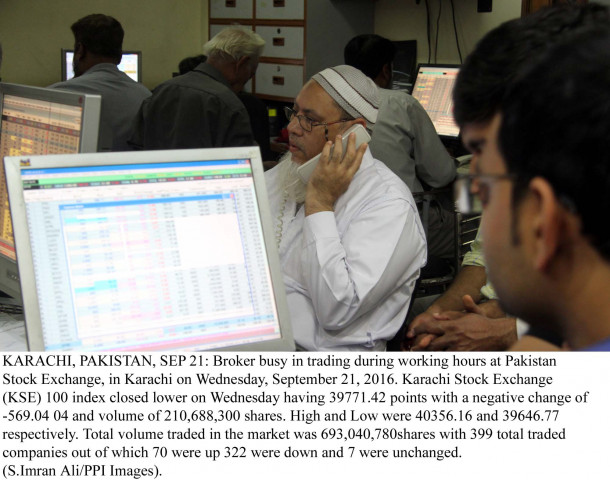

PHOTO: PPI

For long, the KSE-100 had shied away from 41,000 points, retreating every time it came close to the level. However, this week, institutional interest in cement, financial and oil stocks helped the Pakistan Stock Exchange (PSX)’s benchmark index rise to historic levels with volumes surging to new highs as well.

With Pakistan-India relations remaining tense, but somewhat less nerve-wracking than in the previous week, investors continued to buy with minor profit-booking taking away the shine Friday.

The index rose to a record high level of 41,252 on October 5, and followed it up with an almost flat loss of 1 point the next day. It ended at 41,200.48 points on Friday with profit-booking and the upcoming two-day holiday next week meaning that investors were quick to consolidate and post gains of the ongoing week.

The news of Shanghai Stock Exchange’s approach to buy a stake in PSX also drove investors’ mood, overshadowing the uncertainty over political noise and foreign selling.

Across-the-board increase in prices was observed with activity distributed across all major sectors such as cements that rose 2.2% week-on-week. Fertiliser stocks surged +1.9% week-on-week with diminishing foreign selling and value buying, while banks increased +1.7%.

Cement sector witnessed mixed emotions where market’s expectation of strong dispatches data did not live up and surge in coal prices dented the sentiment further. On the other hand, oil and gas sector remained buoyant following jump in crude oil prices to a three-month high that were helped by a fall in crude oil stock as reported in weekly industry data.

Tobacco increased 6%, while power generation sector was down 1% over the outgoing week. Additionally, on the macro front, Moody’s investors’ service maintained a stable outlook for Pakistan’s banking sector and has forecasted gross domestic product growth at 4.9% while International Monetary Fund (IMF) projected a 5% GDP growth rate for Pakistan for FY17.

Market activity picked up during the week with average volumes climbing up by 15% week-on-week to 605 million shares. The oil and gas marketing sector witnessed net selling of $6.3 million, whereas net buying of $5.9 million was seen in banks.

Foreigners remained net sellers for the 6th consecutive week, offloading $8.3 million worth of shares.

Winners of the week

Bank Of Punjab

The Bank of Punjab operates under the status of a scheduled bank in Pakistan. The bank provides commercial bank services.

Shell Pakistan

Shell Pakistan Limited markets petroleum and petrochemical products. The company also blends and markets different types of lubricating oils.

International Steel Limited

International Steels Limited manufactures steel. The company produces cold rolled, sheet, and hot dipped galvanised sheet steels. International Steels serves the construction, appliances, automotive, agricultural implements and packaging industries.

Losers of the week

Pakistan Petroleum

Pakistan Petroleum Limited specialises in the exploration and production of crude oil and natural gas. The company also sells liquefied petroleum gas and condensates.

Honda Atlas Car

Honda Atlas Cars Pakistan Limited manufactures, assembles and sells Honda vehicles through its many divisions within Pakistan.

Pak Suzuki Motors

Pak Suzuki Motor Company Limited manufactures, assembles and markets Suzuki cars, pickups, vans and 4 X 4 vehicles.

Published in The Express Tribune, October 9th, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ