Govt raises at least $1b through Sukuk bonds

Finance minister to announce details of the deal today

The government had granted ten types of tax exemptions on the Islamic bonds aimed at keeping the overall cost of borrowing relatively low.

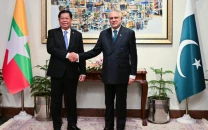

PHOTO: Reuters

Book-building for another ten-year bond was in process by the time this report was filed. “We will finalise the transaction later in the night as it is still in progress,” Finance Minister Ishaq Dar said when asked if the government had raised as much as $1.5 billion through the Sukuk bonds.

Pakistan received nearly $2.4 billion in total offers. The five-year bond has been issued at a profit rate of 5.5%, according to market sources. The rate is lower than the price the country paid two years back for raising $1 billion through the same instrument.

Finance Minister Ishaq Dar will announce details of the deal today (Thursday). Finance Secretary Waqar Masood Khan on Wednesday told Dar that investors showed unprecedented interest in Pakistan and its economy during road shows, an official handout said. The secretary held road shows in Dubai, London, Boston, and New York.

With the fresh borrowings, the PML-N government has so far issued Eurobonds and Sukuk worth over $4.5 billion during its three-year tenure.

It decided to raise the fresh debt to buffer the reserves ahead of some major loan repayments during the second half of this fiscal year. The Paris Club debt payments are also maturing by end of this fiscal year.

The government went to raise debt ten days after the expiry of three-year $6.2 billion International Monetary Fund (IMF) programme. The money has been generated through non-conventional means after the government last week said that, “the trade account has been worsening and consequently pressures are building on the balance of payments.”

The government had granted ten types of tax exemptions on the Islamic bonds aimed at keeping the overall cost of borrowing relatively low.

The finance minister who cancelled his US visit due to Kashmir situation, held two back-to-back video conferences with his team to give final approvals of the transaction.

The 5.5% interest rate is 4.32% over and above the benchmark five-year US Treasury rate. Very low interest rates in Western and European markets amid fears of global slowdown of economies have also increased interest in highly lucrative sovereign papers issued by developing economies.

The surplus liquidity in international market, negative interest rate and Pakistan’s positive growth story helped the government to raise debt at competitive rates, said Khurram Schehzad, Chief Commercial Officer at JS Global.

The International Sukuk market has been projected to remain subdued due to slowdown in Gulf economies. Against last year’s $62 billion international issuances, international credit rating agencies have recently predicted that transactions in 2016 would remain at almost the same level.

Unlike the Eurobond that was issued without collateral, the government has pledged the Islamabad-Lahore Motorway to raise funds that helped it keep the interest rate below the Eurobond transaction when it raised $500 million in September last year at 8.25%. Sukuk is an Islamic bond that has to be backed by collateral.

Published in The Express Tribune, October 6th, 2016.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ