A dip in the price of crude oil meant the index-heavy oil and gas sector opened negative with financial and cement taking away any positive gains to be had.

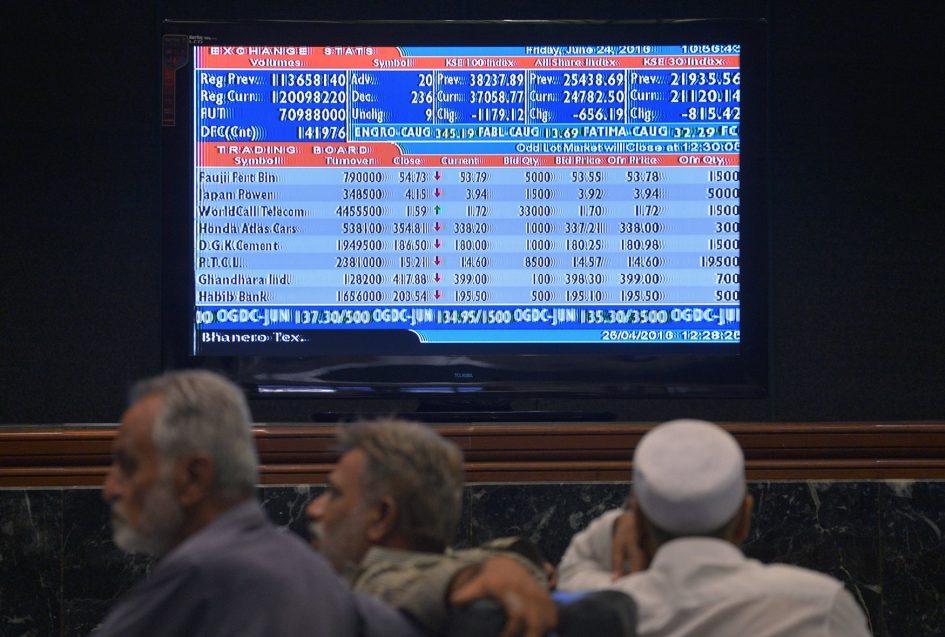

At close on Thursday, the Pakistan Stock Exchange’s benchmark KSE-100 index fell 0.28% or 113.95 points to end at 40,216.35.

Elixir Securities, in its report, stated that stocks skidded lower with index heavy E&Ps taking the lead in declines as investors tracked 8% dip in global crude over holidays; Oil & Gas Development Company (OGDC -2.3%), Pakistan Oilfields (POL -1.4%), Pakistan Petroleum (PPL -0.6%).

“Cements and financials closed mixed on selective interest with third tier stocks to the likes of Bank of Punjab (BOP +9.7%) and Dewan Cement (DCL -4.1%) generating most activity, while index heavy United Bank (UBL -2.88%) led the declines and contributed most to day’s losses on KSE-100 as reports of an aggressive foreign selling did rounds,” said analyst Ali Raza.

“Yield play Hub Power (HUBC -1.2%) also failed to perform despite positive morning news that Nepra has issued generation license to its JV China Power Hub Generation Company, as rumours of a possible restriction to use imported coal for power generation by Government of Pakistan spooked investors,” he added.

“Overall, activity remained focused in small and mid-caps with many retail favourites surging by over 10% intra-day,” said Raza.

Meanwhile, JS Global was of the view that volatility prevailed as the index lost 124 points.

“Pressure was seen in the oil sector on the back of depreciating global crude oil prices as Libya and Nigeria are to gear up to increase production in the upcoming week,” said analyst Ahmed Saeed Khan.

“Biggest laggards of the oil sector were OGDC (-2.34%) and POL (-1.44%),” he added.

“Marginal positivity was witnessed in the cement sector where major gainer of the day in aforementioned sector was BWCL (+1.80%).

“Overall the market sentiment remains volatile, where a cautious approach is recommended,” said Khan.

Trade volumes fell to 531 million shares compared with Friday’s tally of 638 million shares.

Shares of 422 companies were traded on Thursday. At the end of the day, 232 stocks closed higher, 180 declined while 10 remained unchanged. The value of shares traded during the day was Rs11.4 billion.

Pace (Pakistan) Limited was the volume leader with 50.7 million shares, gaining Rs0.84 to finish at Rs9.27. It was followed by Bank of Punjab with 42.9 million shares, gaining Rs1.00 to close at Rs11.31 and Azgard Nine with 29.3 million shares, gaining Rs1.00 to close at Rs7.13.

Foreign institutional investors were net sellers of Rs217 million during the trade session, according to data maintained by the National Clearing Company of Pakistan Limited.

Published in The Express Tribune, September 16th, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1731570357-0/elon-musk-(1)1731570357-0-165x106.webp)

-(1)1717678110-0/Kendrick-(1)-(1)1717678110-0-165x106.webp)

1732486769-0/image-(8)1732486769-0-270x192.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ