Banking sector: Non-performing loans drop to 11.1% in FY16

Advances show considerable growth of 12.6%, touching Rs5.70tr in FY16 compared to Rs5.06tr in previous year

Advances show considerable growth of 12.6%, touching Rs5.70tr in FY16 compared to Rs5.06tr in previous year. PHOTO: FILE

However, in absolute terms, the NPLs stood at Rs634.5 billion in FY16, up 0.71% compared to Rs630 billion in the previous year.

Advances showed a considerable growth of 12.6%, which touched Rs5.70 trillion compared to Rs5.06 trillion a year ago.

According to a segment-wise breakdown, the infection ratio in the small and medium enterprises (SME) sector continued to dominate others with 26.5%, but it fell five percentage points from 31.6% in the previous year.

The infection ratio at the end of June 2016 in the corporate sector - the biggest borrower with more than 75% share in total advances of the banking sector - decreased to 11.8% against 13.4% in the previous year.

In the consumer category, a major decline was noted in the auto industry where the infection ratio came down to 2.4% in FY16 compared to 4.3% in the previous year.

The infection ratio in house financing fell to 21.3% against 24.8% a year ago. However, it jumped significantly to 24% in the area of consumer durables as opposed to 20% in FY15.

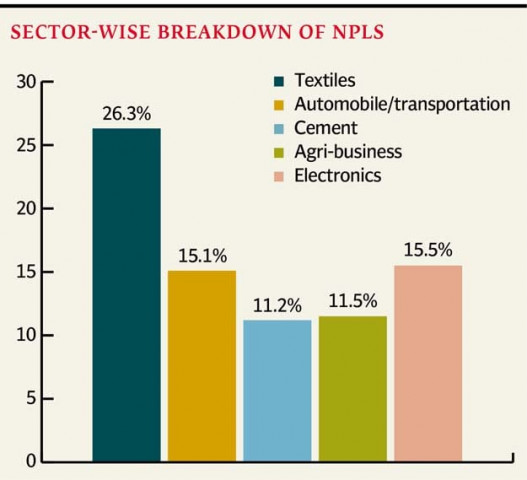

Among different industrial sectors, the highest infection ratio was recorded in the textile sector, but still it came down to 26.3% in FY16 from 28.4% in FY15.

Automobile and transportation is the other major sector where the infection ratio dropped significantly to 15.1% from 19.2%.

Similarly, the NPLs in the cement industry decreased to 11.2% from 14.9%. Moreover, the infection ratio in agribusiness fell to 11.5% from 11.8% and in the electronics sector it slipped to 15.5% from 16.8%.

Instead of looking at bad loans in absolute terms, analysts say such loans should be seen according to their share in total advances of the banking sector. Therefore, the current stock of NPLs poses a minimal threat to the banking system because its share in the total outstanding loans remains thin.

Owing to a significant decline in interest rates in the last one year or so, investment in government papers has become a little less attractive for banks, which is pushing them to lend more to private businesses. Therefore, higher advances are resulting in a reduced infection ratio in the short term.

However, analysts say whenever any sudden increase in advances occurs, it usually leads to an uptick in the NPLs over the next few months or years.

Published in The Express Tribune, September 13th, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ