Index loses 1.2% as negative news remain dominant

Profit-taking in index heavy sectors meant market retreated from bullish sentiment

Allied Rental Modaraba operates an equipment rental company. The company rents branded power generators, material handling equipment and construction machines for all types of applications. PHOTO: ONLINE

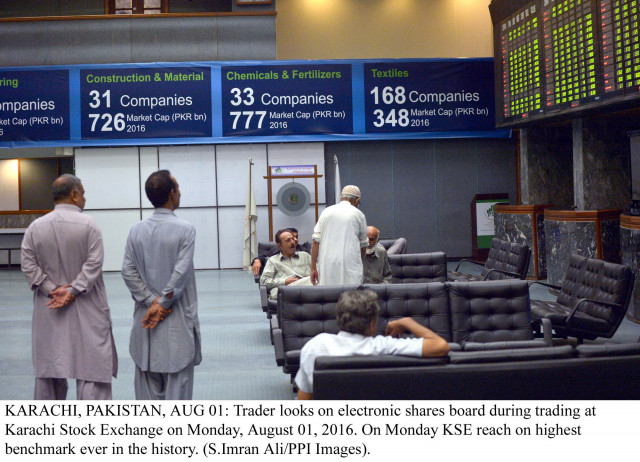

The index crossed the 40,000 level on Monday, signaling signs of bullish sentiments to come, but the advance was short-lived. The following four days saw the KSE-100 Index lose a total of 528 points to close at 39,464.

Profit-taking in heavyweight banking and oil and gas exploration sectors resulted in a waning benchmark KSE-100 index.

Corporate results: Lucky Cement’s earnings surge to Rs16.16 billion

The oil sector was a damper amid downward pressure on crude oil prices after US inventories for the month reached the highest level in at least three decades.

Cement sector also witnessed a bearish spell after announcement of DG Khan Cement (DGKC) to install another line of 2.3 million tons at its Dera Ghazi plant, inciting fears of a large expansion cycle in the industry, which could potentially lead to price wars among the players.

Moreover, rumors of Chinese players planning investment in the cement sector put further pressure, resulting in a -5.5% week-on-week performance of the broader sector.

Auto sector remained the top performer during the week on the back of depreciating yen (1.7% week-on-week) and positive newsflow including Honda Car’s new Civic model gaining popularity and Ghandhara Nissan’s announcement that it has entered into a partnership with Lucky Cement to assist in its Dongfeng Trucks fleet operation.

In terms of turnover, K-Electric (KEL) remained the volume leader during the week on the official announcement by KEL suggesting Shanghai Electric Power Company’s intention to acquire 66.4% shares of the company from Abraaj group.

Market watch: Index dips below 40,000 after volatile session

Additionally a lower than expected consumer price index data (3.64% in Aug-16) also failed to make any impression in the market.

Overall participation remained strong and mainly tilted towards third tier stocks with average volumes and value traded increasing by 60% week-on-week and 25% week-on-week.

Foreigners again turned net sellers at $3.4 million but strong participation from the local market more than absorbed rampant selling.

Winners of the week

Murree Brewery

Murree Brewery Company Limited specialises in the manufacture of beer and Pakistan made foreign liquor. The group also has juice extraction and food manufacturing divisions, located at Rawalpindi and Hattar respectively. Their glass division manufactures all the group’s bottles and jars.

Service (Shoes) Industries

Service Industries Limited specialises in manufacturing tyres and tubes for motorcycles, bicycles, rickshaws and trollies. The company also produces footwear.

Shell Pakistan

Shell Pakistan Limited markets petroleum and petrochemical products. The company also blends and markets different types of lubricating oils.

Losers of the week

Ferozesons Laboratories

Ferozesons Laboratories Limited manufactures and sells pharmaceutical products.

Allied Rental Modaraba

Allied Rental Modaraba operates an equipment rental company. The company rents branded power generators, material handling equipment and construction machines for all types of applications.

Indus Dyeing

Indus Dyeing & Manufacturing Company Limited manufactures and sells yarn.

Published in The Express Tribune, September 4th, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ