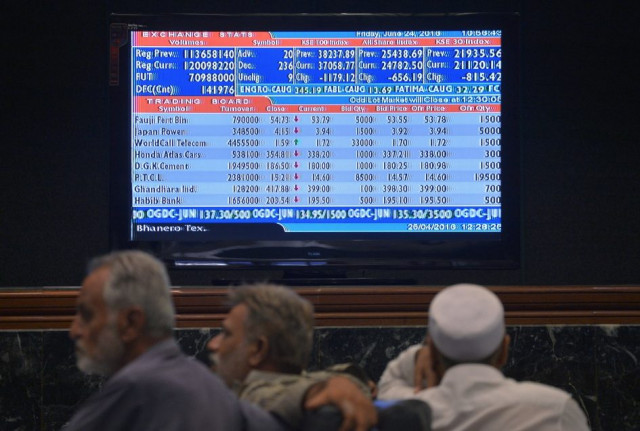

Market watch: Index dips for fourth successive session

Benchmark KSE-100 index falls 56.49 points

Benchmark KSE-100 index falls 56.49 points.

Trading remained largely range-bound with investors expecting cement sales in July to post a decline.

At close on Friday, the Pakistan Stock Exchange’s benchmark KSE-100 index fell 0.14% or 56.49 points to end at 39,390.21.

According to Elixir Securities Ali Raza, equities closed marginally lower after trading range-bound with no clear direction in the wider market. “Market opened sideways and modest gains in oil stocks failed to generate any serious excitement as investors stayed on the side lines, wary of direction of institutional flows and awaiting clarity on domestic politics ahead of planned weekend protests of opposition parties.

“Major sector barring oils skidded lower on limited interest while cements once again weighed most on benchmark KSE-100 index as four out of ten day’s top laggards were cement plays, namely Lucky (-1.1%), Pioneer (PIOC -3.2%), DG Khan (DGKC -0.9%) and Fauji (FCCL -0.9%).

“Volumes were focused in small and mid-cap plays and K-Electric (KEL +5.5%) became the star performer after it sky-rocketed in the last one hour of trading over speculation of stake-sale deal and contributed nearly 61% of total volumes on benchmark KSE-100 index.”

JS Global analyst Ahmed Saeed Khan stated volatility prevailed as the index juggled between +61 and -116 points to end the day on a rather flat note.

“Negativity continued in the cement sector on expectations that local dispatches will show a decline for the month of July; biggest laggards of the sector were Lucky (-1.05%) and PIOC (-3.22%).

“The oil sector remained marginally positive amid global crude oil prices rebounding close to 4% from its bottom this month as US producers decided to control their production and ease the global glut. The biggest index movers of the aforementioned sector were Pakistan Petroleum (+0.60%) and OGDC (+0.41%). Moving forward we expect the volatility and advise buying into dips.”

Trade volumes rose to 263 million shares compared with Thursday’s tally of 205 million shares.

Shares of 368 companies were traded on Friday. At the end of the day 171 stocks closed higher, 180 declined while 17 remained unchanged. The value of shares traded during the day was Rs9.1 billion.

K-Electric was the volume leader with 88.4 million shares, gaining Rs0.45 to finish at Rs8.65. It was followed by Dewan Cement with 28.4 million shares, losing Rs0.53 to close at Rs16.60 and Dewan Salman with 18.2 million shares, gaining Rs0.68 to close at Rs2.84.

Foreign institutional investors were net buyers of Rs410 million during the trade session, according to data maintained by the National Clearing Company of Pakistan Limited.

Published in The Express Tribune, August 6th, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ