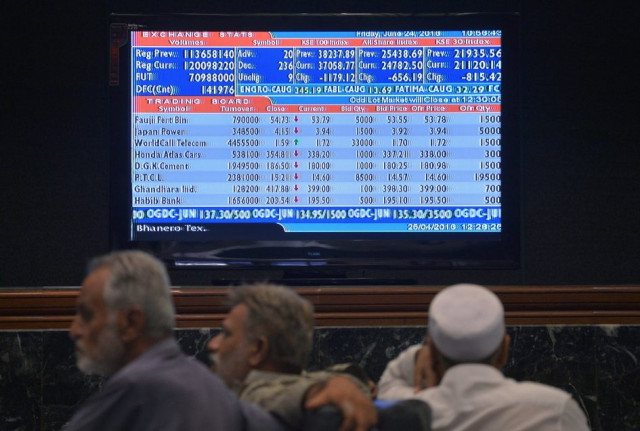

The Pakistan Stock Exchange’s (PSX) benchmark KSE 100-share Index fell 0.39% or 155.01 points to end at 39,151.78.

According to Elixir Securities analyst Ali Raza, the equities hit the brakes after surging on Thursday and closed last day of the week in the red.

“The benchmark KSE-100 index rose 113 points, or 0.3%, to test another all-time high, but failed to sustain the momentum and selling primarily in index names drove the index down.

“Index-heavy exploration and production sector weighed on the market early on, tracking the dip in global crude while financial stocks closed lower with index-heavy Habib Bank (-1.2%) denting the KSE-100 index the most.”

Overall, limited activity was witnessed in blue-chip stocks while retail investors were aggressive in small and mid-caps that occupied all the top 10 slots on the volumes chart.

“Expect selective interest to continue with the earnings season gaining most attention while flows will help set the tone with the benchmark likely to retest and surpass the all-time high.”

Meanwhile, JS Global analyst Nabeel Haroon said the market opened on a positive note as the index rallied to hit an intraday high of +114 points but came under selling pressure during second half of the trading session.

“Profit-taking was seen in the fertiliser sector as it closed 1.1% lower from its previous day’s close. Major laggards of the sector were Engro Fertilizers (-1.11%) and Fauji Fertilizer (-1.78%).”

OGDC (-1.32%), Pakistan Petroleum (-1.92%) and Pakistan Oilfields (-0.41%) in the exploration and production sector remained under pressure during the trading session, as crude oil prices fell to trade below $45 per barrel (for West Texas Intermediate).

“Moving forward we maintain our bullish stance on the market ahead of results season and recommend investors to accumulate on weakness.”

Trading volumes fell to 220 million shares compared with Thursday’s tally of 234 million.

Shares of 344 companies were traded. At the end of the day, 161 stocks closed higher, 167 declined while 16 remained unchanged. The value of shares traded during the day was Rs11.8 billion.

TRG Pakistan was the volume leader with 19.3 million shares gaining Rs0.57 to finish at Rs36.06. It was followed by Byco Petroleum with 19.25 million shares gaining Rs1.11 to close at Rs23.41 and Pak Elektron with 16.3 million shares gaining Rs0.48 to close at Rs69.92.

Foreign institutional investors were net sellers of Rs1.765 billion during the trading session, according to data maintained by the National Clearing Company of Pakistan Limited.

Published in The Express Tribune, July 23rd, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ