Weekly review: KSE-100 jumps 980 points on back of rising oil prices

Banking, oil and gas sectors contributed most to the index’s gains

Banking, oil and gas sectors contributed most to the index’s gains.

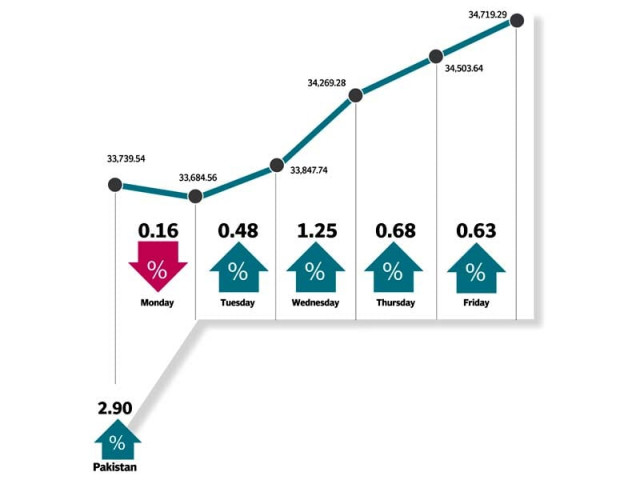

The rally in global crude oil prices resulted in a bull-run at the stock market with the benchmark KSE-100 index climbing 980 points (2.9%) during the week ended April 29.

With oil prices continuing their upward trend, the heavyweight oil and gas sector put on a strong show. Rising oil prices also meant that higher inflation could be expected in the coming weeks resulting in the banking sector gaining investor interest. The last week of the corporate earnings season also pulled off some surprises which provided a boost to the market.

The week started off on a negative note following news that the government was going to extend the Super Tax of 4% levied on businesses earning more than Rs500 million annually, to support the ongoing Zarb-e-Azb operation. The KSE-100 index shed 55 points on the opening day of the week.

The negativity was, however, short-lived as the market rebounded the following day and never looked back, racking up 1,034 points in the remaining 4 days of the week. The oil and gas sector led the gains, followed closely by the banking sector which also saw decent gains.

Oil prices continued to defy expectations after the failure of oil producers reaching a consensus on a production freeze. Supply disruptions in various countries helped to narrow the supply-demand gap which in turn pushed the price of Brent crude as high as $47 per barrel during the week. The sector rose 5.8% during the week with the OGDC and PPL contributing 207 points to the KSE-100’s gains.

The rising oil prices meant higher inflation in the coming months, which could result in the central bank increasing the discount rate later in the year. The hope of that happening led to a rally in the banking sector where Habib Bank Limited was the star performer, climbing 8.5% and contributing 182 points to the KSE-100 index alone.

It was a mixed week for the fertiliser sector where disappointing earnings by Fauji Fertilizers were offset by OGRA’s decision to reverse the feed gas tariff by Rs77 per mmbtu to pre-September 2015 levels, resulting in manufacturers cutting prices by Rs70 per bag, making them more competitive against imported fertiliser.

Foreigners continued to be net sellers at the bourse, offloading net equity worth $12.4 million as opposed to net selling of $28.3 million in the previous week.

Average daily volumes stayed steady at 242.3 million shares traded per day, an improvement of 1.3% over the previous week. Average daily volumes rose 16.5% to Rs11.76 billion per day as blue-chip stocks garnered higher interest. The Pakistan Stock Exchange’s market capitalisation stood at Rs7.21 trillion ($68.7 billion) at the end of the week.

Winners of the week

Pakistan Tobacco Company

Pakistan Tobacco Company Limited manufactures and sells cigarettes.

Feroze1888 Mills

Feroze1888 Mills Ltd manufactures and sells a wide range of cotton towels and fabrics.

International Steels Limited

International Steels Ltd manufactures steel. The company produces cold rolled, sheet, and hot dipped galvanised sheet steels. International Steels serves the construction, appliances, automotive, agricultural implements, and packaging industries.

Losers of the week

Indus Dyeing

Indus Dyeing & Manufacturing Company Ltd manufactures and sells yarn.

Pak Suzuki Motor Co

Pak Suzuki Motor Company Limited manufactures, assembles and markets Suzuki cars, pickups, vans and 4X4 vehicles.

Lalpir Power Limited

Lalpir Power Limited was incorporated in Pakistan in 1994. The principal activities of the company are to own, operate and maintain an oil-fired power station having gross capacity of 362MW in Mehmood Kot, Muzaffargarh, Pakistan.

Published in The Express Tribune, May 1st, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ