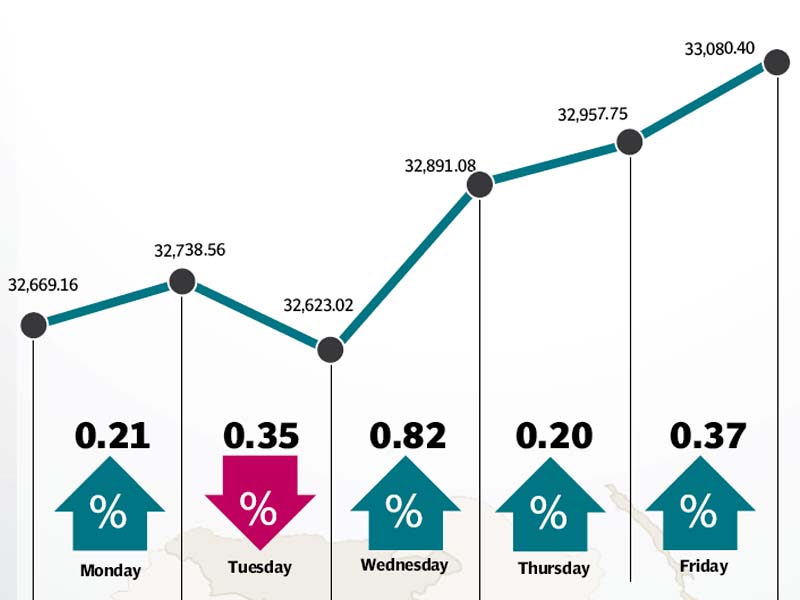

The stock market remained mostly in the positive territory in the week ended on March 18, closing at 33,080 points, up 1.14% week-on-week.

The gains came as a result of rising international crude oil prices that managed to sustain the positive run and climbed to $40 per barrel on encouraging inventory data and news hinting that OPEC would agree on a production freeze in its next meeting.

Taking cue from the global trend, the domestic oil and gas sector dominated the trading sessions and continued to spur investor interest. The uptick in oil prices in the last two trading days took investors by surprise. With oil prices consolidating above $40 per barrel, the oil and gas sector will likely enjoy investor interest given its low valuation.

Investors were enthusiastic for most of the week and the market closed negative for only one day, ie Tuesday. Triggers were absent at the beginning of the week, but uptick in international oil prices and interest in banking stocks sparked buying activity. The rally in stocks of Pakistan Petroleum Limited and Oil and Gas Development Company led to a cumulative addition of 100 points to the index.

During the week, fertiliser stocks came under pressure with the provisional data showing a significant decline in urea sales of the industry. Although fertiliser prices continued to hold ground, analysts see a tangible risk of a fall in the next few months.

The auto sector also attracted attention as the government finalised the new auto policy. The policy offers tax incentives to the new entrants only to break the monopoly of existing three assemblers in the auto sector.

Additionally, the cement sector continued to perform on strong fundamentals, led by Cherat Cement and Lucky Cement.

Major losers of the week were chemical stocks, which declined 2.6% and food producers, which fell 2%.

Other key highlights of the week included a plan by China Three Gorges to construct $9 billion worth of hydroelectric power projects under the China-Pakistan Economic Corridor. Foreign direct investment rose 5% year-on year in the first eight months of financial year 2015-16 to $751 million whereas the trade deficit went down 12%.

Contrary to the previous week when foreign investors were net buyers, they turned net sellers of $7.6 million worth of shares in the week under review.

Average daily volumes fell 5% and were recorded at 166.8 million shares whereas average daily values dropped 13% to Rs7.9 billion.

Winners of the week

Allied Rental Modaraba

Allied Rental Modaraba operates an equipment rental company. The company rents branded power generators, material handling equipment and construction machines for all types of applications.

Packages Limited

Packages Limited manufactures and sells paper, tissue products, paperboard and packaging materials. The group has joint venture agreements with Tetra Pak International, to manufacture paper for liquid food packaging, the Mitsubishi Corporation, to manufacture polypropylene films, and Printcare (Ceylon) Limited, to produce flexible packaging materials in Sri Lanka.

Attock Refinery

Attock Refinery Limited, a subsidiary of the Attock Oil Company, specialises in the refining of crude oil.

Losers of the week

Fatima Fertilizer Company Ltd

Fatima Fertilizer Co Ltd. produces fertilisers. The company is developing a fully integrated fertiliser complex, capable of producing Ammonia, Nitric Acid, Nitro Phosphate (“NP”), Nitrogen Phosphorous Potassium (“NPK”), and Calcium Ammonium Nitrate (“CAN”).

Gul Ahmed Textile

Gul Ahmed Textile Mills Limited manufactures and sells textile products.

Lalpir Power Limited

Lalpir Power Limited was incorporated in Pakistan in 1994. The principal activities of the company are to own, operate and maintain an oil-fired power station having gross capacity of 362MW in Mehmood Kot, Muzaffargarh.

Published in The Express Tribune, March 20th, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1737706680-1/emilia-perez-(2)1737706680-1-165x106.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ