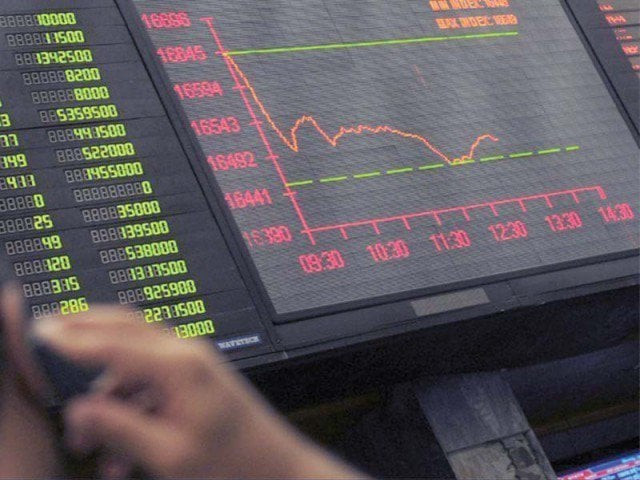

Market watch: Index ends with a bang, gains 492 points

Benchmark KSE-100 index rises 1.60%

Benchmark KSE-100 index rises 1.60%. PHOTO: FILE

Excitement over Prime Minister Nawaz Sharif’s visit to Karachi and an uptick in the price of international crude oil played their part in getting the bulls excited.

At close on Friday, the Pakistan Stock Exchange’s benchmark KSE-100 index rose 1.60% or 491.55 points to end at 31,294.08.

Elixir Securities analyst Ali Raza said equities surged to close the week positive on improved turnover led by gains in oils, cements and select financials.

“Wider market opened positive tracking regional markets, and oil stocks took early lead following higher international crude.

“Lagging cements also came in the limelight the prime minister visited Karachi to inaugurate the rapid transit project. Gains were gradually added in first session as benchmark index settled over 31k before break.

“However, at the outset of second session, market’s momentum gathered pace and KSE-100 index soared by nearly 250 points.

“Index heavy Habib Bank (HBL, +1%), Lucky Cement (+3.5%), Engro Corp (+2.9%) and Oil and Gas Development Company (OGDC, +1.6%) attracted institutional flows and contributed most points to the gains, while small and mid-caps also rose after witnessing increased participation from savvy investors.”

Meanwhile, JS Global analyst Arhum Ghous said that positivity prevailed in the market as the index rallied to close 1.6% up from the previous day close as healthy corporate results and recovery in oil prices remained incited interest in the market.

“Gul-Ahmed Textile (GATM) closed on its upper circuit as the textile manufacturer posted better than expected results, with GATM posting an earnings-per-share (EPS) of Rs1.85 for the first half of the fiscal year and a Rs1 per share dividend.

“Similarly, better than expected result of Fecto Cement (2QFY16 EPS Rs4.61, up 90% YoY) helped it close on its upper circuit.

“Overall revival of investor’s interest in the market also helped Sui gas twins close the last trading day of the week at upper cap. Most of the euphoria into the market was injected by recovery in oil prices where key exploration and production stocks namely OGDC (+3.14%), POL (+1.11%) and PPL (+1.95%) closed in the green zone.

“Going forward, market if expected to sustain its positive momentum where any negative variation in international oil prices will serve as a major risk.”

Trade volumes rose to 125 million shares compared with Thursday’s tally of 121 million shares.

Shares of 336 companies were traded on Friday. At the end of the day, 219 stocks closed higher, 98 declined while 19 remained unchanged. The value of shares traded during the day was Rs7.0 billion.

Sui Southern Gas was the volume leader with 6.8 million shares, gaining Rs1.29 to finish at Rs27.43. It was followed by TRG Pakistan with 6.0 million shares, gaining Rs0.40 to close at Rs24.40 and Telecard Limited with 5.9 million shares, gaining Rs0.25 to close at Rs2.86.

Foreign institutional investors were net buyers of Rs34 million during the trade session, according to data maintained by the National Clearing Company of Pakistan Limited.

Published in The Express Tribune, February 27th, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ