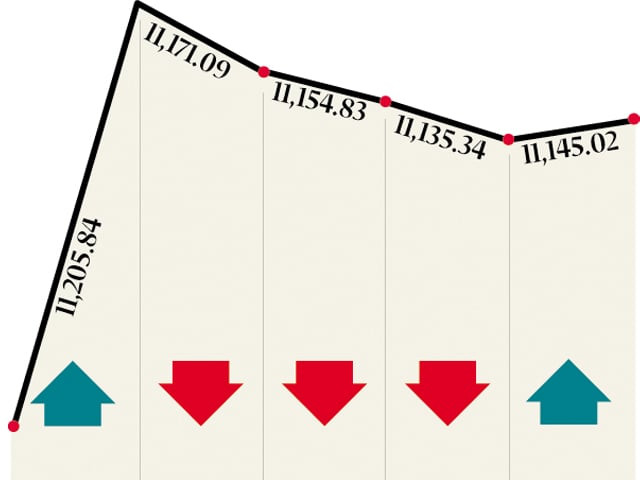

Weekly review: Bull-run continues as KSE-100 climbs 1.2%

Heavy foreign buying and approval of margin trading lead to more participation.

Weekly review: Bull-run continues as KSE-100 climbs 1.2%

Heavy foreign buying and approval of long-awaited margin trading system (MTS) by the law ministry provided the impetus needed by investors to buy further into the overbought market. Volumes were up 20 per cent over the previous week and an exceptionally high number of shares were traded in the final two sessions of the week.Foreign buying was highly skewed towards the fertiliser and banking sectors on expectations of higher dividend payout. Foreigners picked up a net of $29.3 million worth of equities during the week, taking total foreign buying since the start of the year to $41 million.

Engro Corporation and Fauji Fertiliser were the biggest beneficiaries as their stocks climbed 9.4 per cent and nine per cent, respectively. Fauji Fertiliser Bin Qasim also gained 6.7 per cent. MCB Bank was the biggest gainer within the banking sector and shot up 7.7 per cent. Historically, MCB has been a favourite of foreign buyers. Investors were provided another reason to participate in the bourses as towards the end of the week, the law ministry approved the long-awaited margin trading system. Earlier, the MTS had been put on hold after reservations were expressed about its implementation.

A long stand-off between the KSE management and the Securities and Exchange Commission of Pakistan (SECP) came to an end after former KSE member Muhammad Ali Ghulam Muhammad was appointed chairman of the commission. Since then, some progress on the MTS front has been seen and the leverage product is expected to be implemented soon.

As a result of the positive developments, investors flocked to the market in the closing sessions and volumes of 229 million shares and 300 million shares were recorded on Thursday and Friday, respectively.

The rally was broad-based and the oil and power sector continued to flourish on the back of higher oil prices in global markets. Pakistan Oilfields Limited (POL) continued its impressive run and gained 2.7 per cent during the week. On the other hand, half-year macroeconomic data became available and did not provide anything to investors to cheer about. Half-year inflation stood at 15.5 per cent, fuelling speculations of another discount rate hike. The country’s trade deficit also rose to $8.2 billion, up 18.2 per cent from the previous year. Large-scale manufacturing (LSM) declined 2.3 per cent in the first half of 2010-11.

Owing to the high volumes in the last two sessions, average daily turnover rose 19.8 per cent to 185 million shares. Average daily value also climbed 32.2 per cent to Rs10 billion, reflecting higher trading in first-tier stocks. Total market capitalisation rose 1.2 per cent to Rs3.4 trillion.

What to expect?

With the half-year earnings season expected to kick off in coming weeks, stock-specific activity will be witnessed and can lead to decent gains for the market in the short-run. Furthermore, continued foreign inflows and the build-up to the implementation of the MTS will help in sustaining the bullish run.

However, with inflation numbers not coming under control, a discount rate hike at the end of the month could make investors pessimistic. It should also be kept in mind that regional markets have been going through a correction phase, and Pakistan’s market can be expected to follow suit.

Monday,January 10

After witnessing a volatile trading session, the local bourse ended on a negative note eroding gains recorded earlier on in the day.

The benchmark 100-share index at the Karachi Stock Exchange (KSE) lost 82.34 points, or 0.66 per cent, to close at 12,306.7 points

Tuesday,January 11

Volatility was witnessed for a second day in a row at the local bourse largely on the back of profit-taking in index heavyweight Oil and Gas Development Company.

The 100-share index at KSE lost 39.49 points, or 0.32 per cent, to close at 12,267.21 points

Wednesday, January 12

A buying spree by local and foreign fund managers helped the local bourse sustain slight gains amidst a shaky trading session, according to analysts.

The benchmark index rose 14.03 points, or 0.11 per cent, to close at 12,281.24 points

Thursday, January 13

News of the margin trading system (MTS) being approved by the law ministry led to aggressive buying at the local bourse, according to analysts.

The benchmark 100-share index gained 178.2 points, or 1.45 per cent, to close at 12,459.44 points

Friday, January 14

Bulls continued the run at the KSE, anticipating early launch of the margin trading system and announcement of attractive corporate earnings, according to analysts.

The benchmark KSE-100 index strengthened 74.1 points, or 0.59 per cent, to close at 12,533.54 points

Published in The Express Tribune, January 16th, 2011.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ