Weekly review: KSE-100 rises 349 points as oil prices bounce back

Oil and gas sector leads gains with cement stocks contributing positively

Oil and gas sector leads gains with cement stocks contributing positively.

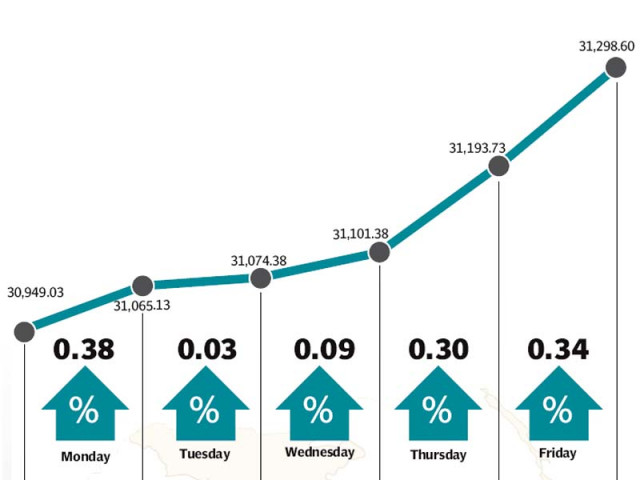

The stock market bounced back after three consecutive weeks of decline as a surge in oil prices helped the benchmark KSE-100 index gain 349 points (1.1%) to close at 31,298 during the week ended January 29.

The KSE-100 suffered a torrid start to 2016 with the index falling 2,279 points (5.7%) in the opening three weeks of the year as turmoil in regional markets coupled with plummeting crude oil prices wreaked havoc on the bourse.

Investors took a backseat ahead of the monetary policy announcement due on Saturday, but the surprising bounce back in crude oil prices and the attraction of stocks at low valuations resulted in a rally which lifted the entire market.

Volumes fell 20% during the week and foreigners continued to be net sellers, but the market showed resilience as the start of earnings season encouraged sector-specific rallies. The index made small, but sure gains and managed to close in the black in all five trading days of the week.

With the monetary policy announcement right around the corner, investors adopted a wait and see approach. The market largely expected a 50-basis-point rate cut as persistently low inflation coupled with declining cut-off rates in the Pakistan Investment Bond (PIB) auction raised hopes that the State Bank would reduce the benchmark interest rate.

Oil prices took a surprising turn in the week and bounced back sharply after hitting a 12-year low of $28 per barrel at the end of the previous week. Prices went up as high as $34 per barrel mid-week, sparking a rally in the heavyweight oil and gas sector.

OGDC and Pakistan Petroleum rose 5.5% and 4.2% respectively, providing a 108-point boost to the KSE-100 index.

The results season got under way during the week with strong numbers coming in from the cement sector. Cement companies have reported growing sales in recent months, which were reflected in Maple Leaf and Kohat Cement earnings. The sector rallied as a whole following the results and provided a boost to the index.

Foreigners were again net sellers as volatility in regional markets continued to prevail. Foreign net selling stood at $7 million for the week, but was a far cry from the $31.7 million net selling registered in the previous week.

Average daily volumes fell sharply by 20.8% and were recorded at 116.8 million shares, down from 147.5 million shares in the previous week.

Average daily values also fell 12.7% to Rs6.99 billion from Rs8.01 billion last week. Pakistan Stock Exchange’s market capitalisation stood at Rs6.70 trillion ($63.8 billion) at the end of the week.

Winners of the week

Ibrahim Fibres

Ibrahim Fibres Limited, a part of the Ibrahim Group, operates a polyester staple Fibre manufacturing plant. The company manufactures a wide range of polyester staple fibre and it also manufactures a variety of blended as well as pure synthetic yarns. Ibrahim Fibres also owns an in-house power generation plant.

Pakistan Tobacco Company

Pakistan Tobacco Company Limited manufactures and sells cigarettes.

Pakchem Limited

Pakchem Limited is one of the largest producers of guar gum in Pakistan and is the only public limited company in the guar industry, listed on the Pakistan Stock Exchange.

Losers of the week

Ferozsons Laboratories

Ferozsons Laboratories Limited manufactures and sells pharmaceutical products.

Shifa Int Hospitals

Shifa International Hospitals Limited establishes and runs medical centres and hospitals in Pakistan. The company’s clinical services include medicines, paediatrics, surgical, obstetric and gynaecology, dentistry, rehabilitation services and ophthalmology.

Nestle Pakistan

Nestle Pakistan Limited manufactures, imports and sells dairy products, confectioneries, culinary products and fruit juices. The group’s products include milk, butter, cream, noodles, coffees, and dietary and infant products.

Published in The Express Tribune, January 31st, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ