Weekly review: Index bleeds 1,533 points amid global turmoil

Oil and gas sector was hit hardest with crude prices slumping to 12-year low

Oil and gas sector was hit hardest with crude prices slumping to 12-year low.

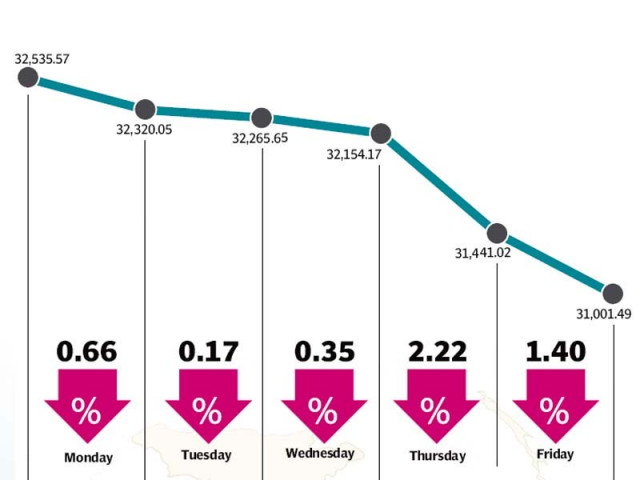

The ongoing global equity crisis took a heavy toll on the local stock market with the benchmark KSE-100 index closing negative for five days in a row, shedding 1,533 points (4.7%) during the week ended January 15.

With economic indicators from China signaling slowing growth in the world’s second largest economy, global equity markets went in a flux and the effects were felt in the local market as well that ended negative for a 10th successive session. With crude slumping to a 12-year low, the heavyweight oil and gas sector crashed and contributed the biggest losses to the KSE-100 index.

The ongoing investigations by the Federal Investigation Agency (FIA) against stock market brokers did not help matters while general pessimism led to panic selling at the bourse which resulted in losses across the board in all major sectors.

The week started off on a negative note as political parties clashed over implementation of the China Pakistan Economic Corridor (CPEC) and regional equity markets plunged after declines in the Chinese stock market.

The situation became worse in the second half of the week after crude prices fell below $30 per barrel for the first time in 12 years, which sparked massive selling in the heavyweight oil and gas sector. The KSE-100 index shed 1,152 points (3.6%) in the final two days alone to close barely above the 31,000 point barrier on Friday.

China’s growth prospects, coupled with inflating US crude oil inventory and OPEC’s reluctance to curb oil production led to a massive drop in crude oil prices during the week, falling below $30 per barrel on Friday.

All three major oil and gas sector companies, the Oil and Gas Development Company, Pakistan Petroleum Limited and Pakistan Oilfields witnessed sharp declines during the week with their share prices hitting five-year lows.

The cement sector and steel sectors were the bright spots at the bourse. Cement sales grew 16% during the first half of the current fiscal year, which provided a boost to the sector helping it outperform the market. The steel sector also remained positive during the week with the government imposing duties on the import of cold-rolled coil which would benefit local manufacturers.

Foreigners finally turned net buyers, albeit by a very small amount, as they bought net equity worth $1.2 million during the week as opposed to the $11.3 million net selling in the previous week. It was the first time in more than a month that foreigners were net buyers at the bourse during a week.

Average daily volumes rose 9.7% and stood at 131.4 million shares traded per day while average daily values fell 4.7% and were recorded at Rs7.26 billion per day. The Pakistan Stock Exchange’s market capitalisation stood at Rs6.57 trillion ($62.6 billion) at the end of the week.

Winners of the week

Feroze 1888 Mills Limited

Is the manufacturer and exporter of specialised yarn and textile terry products in Pakistan.

Servis (Shoes) Limited

Servis is the largest retail network in Pakistan, with more than 450 retail outlets and roughly 2,500 independent dealers, delivering good quality footwear to consumers every day.

International Steels Ltd

International Steels Ltd. manufactures steel. The company produces cold rolled, sheet, and hot dipped galvanised sheet steels. International Steels serves the construction, appliances, automotive, agricultural implements, and packaging industries.

Losers of the week

TRG Pakistan

TRG Pakistan operates as an information technology company. The company provides business support and software services to companies. TRG Pakistan manages call centres and offices located in Pakistan and elsewhere in the world.

Jahangir Siddiqui & Company Limited

Jahangir Siddiqui & Company Limited is an investment firm, offering share brokerage, money market, advisory and consultancy, underwriting and portfolio management services.

Pakistan Oilfields

Pakistan Oil Fields Limited specialises in the exploration, drilling, production and transmission of petroleum. The company also markets Liquified Petroleum Gas (LPG).

Published in The Express Tribune, January 17th, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ