After opening the New Year on a strong note, the market’s rally fizzled out as global equity markets reacted to the crash in the Chinese stock market. The week also saw the price of crude oil fall to 12-year lows during the week which had a disastrous effect on the heavyweight oil and gas sector.

The situation was made worse by FIA investigations against one of the largest brokerage houses in the country over fraud charges. Foreigners also continued to be net sellers and contributed to the market’s decline.

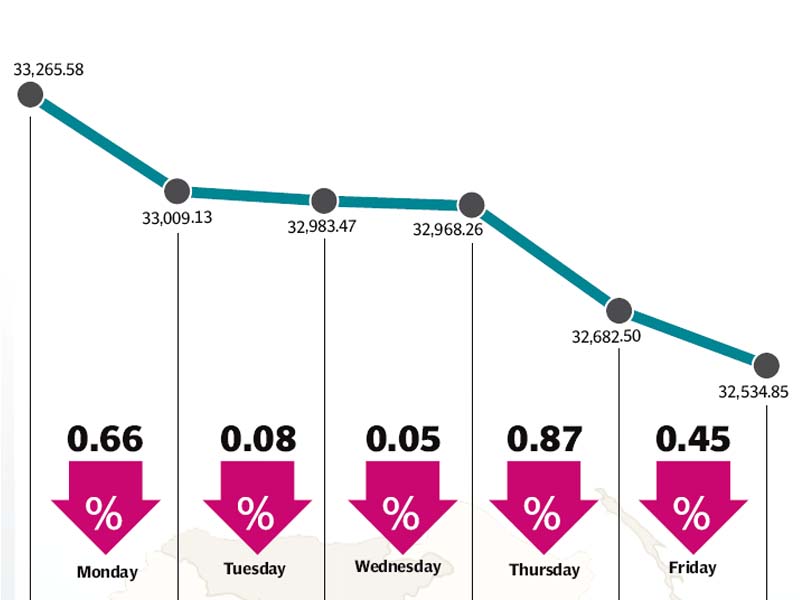

The market opened the week on a negative note in reaction to the steep decline in the Chinese stock market as the KSE-100 shed 219 points on Monday. The index would stabilise in the following couple of days with support from the cement, autos and pharma sectors.

However, the stability did not last long as the mid-week plunge in crude oil price and a second round of equities slump in China bore heavily on the market with the KSE-100 shedding 433 points in the final two days to end the week at 32,535 points on Friday.

The biggest impact on the stock market this week came from abroad as the Chinese stock market crash had far reaching impact on global markets. The Chinese market had to be closed twice during the week after hitting the lower circuit breaker of 7% on Monday and Thursday, with both days leading to equity sell-off across the globe.

The week Chinese data coupled with tensions between Saudi Arabia and Iran led to crude oil prices crashing again this week falling to a 12-year low of $33.27 per barrel during the week. The slump wreaked havoc with Pakistan Oilfields and the Oil and Gas Development Company falling 9.4% and 7.7%, respectively, and knocking off 176 points from the KSE-100 index.

In the midst of all the selling, there were strong performances from the cement, auto and pharma sectors. Cements and autos rose on strong sales numbers while the pharma sector gained after the government announced plans to bulk buy vaccinations for common diseases.

Foreign selling again shot up in response to the Chinese crisis and foreigners ended the week offloading net equity worth $11.3 million as opposed to the net selling of $4.3 million in the prior week.

Average daily volumes improved 5.4% and stood at 119.8 million shares traded per day while average daily values also rose 15.4% and were recorded at Rs7.6 billion per day. The Karachi Stock Exchange’s market capitalisation stood at Rs6.89 trillion ($66.2 billion) at the end of the week.

Winners of the week

Ferozsons Laboratories

Ferozsons Laboratories Ltd manufactures and sells pharmaceutical products.

Pak Elektron Limited

Pak Elektron Limited manufactures and sells a variety of electrical products and domestic appliances. The group’s power products include transformers, energy meters and switchgears. Their appliances consist of a range of deep freezers and air conditioners. The group also has an agreement with Sony Pakistan (Pvt) Ltd, for which Pak Elektron will manufacture Sony brand televisions.

Pakistan Tobacco Company

Pakistan Tobacco Company Limited manufactures and sells cigarettes.

Losers of the week

Allied Rental Modaraba

Allied Rental Modaraba operates an equipment rental company. The company rents branded power generators, material handling equipment and construction machines for all types of applications.

Pakistan Oilfields

Pakistan Oilfields Limited specialises in the exploration, drilling, production and transmission of petroleum. The company also markets Liquefied Petroleum Gas (LPG).

Oil & Gas Development Co

Oil & Gas Development Co Ltd explores and develops oil and natural gas properties in Pakistan.

Published in The Express Tribune, January 10th, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1719660634-1/BeFunky-collage-nicole-(1)1719660634-1-165x106.webp)

1732276540-0/kim-(10)1732276540-0-165x106.webp)

COMMENTS (1)

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ