Seminar on sales tax: Tax evasion becomes a norm that eats billions

UAF VC says revenue receipts allow govt to work for society’s welfare

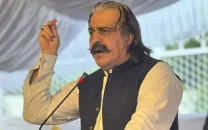

Speaking at a seminar titled ‘Punjab Sales Tax Act 2012’, arranged by the US-Pakistan Centre for Advanced Studies in Agriculture and Food Security, UAF, Khan said it was a matter of concern that people did not want to pay taxes and were looking for ways to avoid it.

Common place: Tax evasion has become a norm, says UAF VC

“Tax enables the government to run its functions smoothly for the welfare of society. Zakat and Ushr is also a form of tax that is collected from the well-off people and distributed to the deprived segment,” he said.

“Pakistan is facing several challenges. We have to make joint efforts for poverty alleviation and food security.”

Punjab Revenue Authority Faisalabad Commissioner Imran Hayee Khan pointed out that the devolution of power, under the 18th Constitution Amendment, had shifted the collection of sales tax on services from the federal government to provinces.

Pakistan’s revenue collection surpasses target

Different boards and revenue authorities have been established at provincial levels to make the collection and address relevant issues. “Sindh took the lead in setting up the revenue board, followed by Punjab, Khyber-Pakhtunkhwa and Balochistan,” he said.

UAF Treasurer Umar Saeed, while briefing the audience about the Punjab Sales Tax Act 2012, stressed that people should be made

aware of the importance of taxes and extra measures must be taken to educate them.

“There is a dire need for strengthening the direct tax system,” added US-Pakistan Centre for Advanced Studies’ Chief of Party Dr Bashir Ahmad. “Thirty-nine per cent of the tax is being collected as direct tax while the rest is received in the form of indirect tax.”

Published in The Express Tribune, January 1st, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ