Open but not trading: Myanmar launches fledgling bourse

Analysts say the country has a long way to go to build trust in its new market

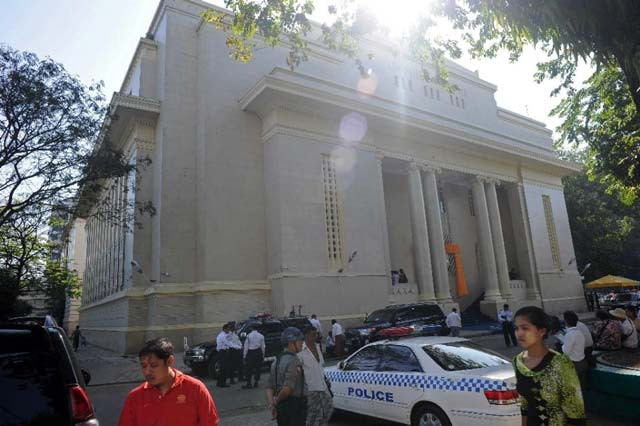

Myanmar officially launched its first modern stock exchange in Yangon on December 9, 2015, without a single stock to trade, as the nation's latest drive for economic revitalisation struggles to take flight. PHOTO: AFP

Aung San Suu Kyi's pro-democracy party swept elections last month, boosting confidence in the former junta-run nation's reforms, which have also creaked open the door to its reclusive economy.

The bourse opened with the clanging of a large ceremonial bell on Wednesday, marking an ambitious new stage in the nation's efforts to ignite investment.

People pose for photos during the opening ceremony of the Yangon Stock Exchange, on December 9, 2015 . PHOTO: AFP

People pose for photos during the opening ceremony of the Yangon Stock Exchange, on December 9, 2015 . PHOTO: AFP"We have a dream and this morning this dream has come true," said Maung Maung Thein, head of Myanmar's Securities and Exchange Commission, in an opening speech at the newly restored colonial-era building housing the Yangon Stock Exchange (YSX).

Pakistani ticketing startup Bookme expands into Myanmar

He said six Myanmar firms had been approved to list on a market tipped to be "instrumental to the growth of our economy".

Those companies, which include the Japan-backed Thilawa Special Economic Zone and First Myanmar Investment run by Myanmar tycoon Serge Pun, "will be going into the annals of our history", he added.

But they will have to wait until February or March to begin trading, after delays in confirming underwriters pushed back the timeframe for initial public offerings.

Trading ambitions

The lack of active trading did not stop officials from proudly screening a mock-up of the stock exchange for guests on Wednesday.

Vice President Nyan Tun, who rang the bell, told reporters that while the stock market would start out with only Myanmar firms, authorities hope it will become a regional player.

But analysts say the country has a long way to go to build trust in its new market.

Mixo Das, of Nomura in Singapore, said the bourse would need to build a track record of good governance, trading history and market liquidity.

The bourse had been decades in the making in Myanmar, one of only a handful of nations without a modern stock exchange. PHOTO: AFP

The bourse had been decades in the making in Myanmar, one of only a handful of nations without a modern stock exchange. PHOTO: AFP"I think the stock exchange in Myanmar will be much like the ones in Laos or Cambodia -- more as a source of national pride and learning experience for the first several years," he added.

Myanmar languished under the yoke of the military for around half a century.

A once-buoyant economy was trammelled by state mismanagement, isolation and heavy sanctions imposed by Western nations for major human rights abuses.

It still faces steep challenges including rampant corruption, a murky legal system, dismal infrastructure and a widespread distrust of the banking system.

Myanmar ruling party battered by Suu Kyi at polls

But reforms since 2011 have raised hopes of an economic renaissance in the nation of 51-million people, which has rich natural resources and a strategic location between India, China and Southeast Asia.

Rajiv Biswas, of IHS Global Insight, said the bourse will be an important tool in developing the country's financial system, with the listing of larger banks and corporations promising to help the creation of equity and pension funds.

It could also help a new government, run by Suu Kyi and her party, tackle hulking state-owned enterprises, enabling capital raising for partial privatisations, he said.

Myanmar's bourse has been decades in the making.

In 1996 Japanese firm Daiwa Securities and a state bank set up the Myanmar Securities Exchange Centre, but this allowed over-the-counter sales of shares in just two firms, a Myanmar timber company and bank.

Official media has said state-owned Myanma Economic Bank will own a controlling 51 percent stake in YSX, with the remainder divided between Japanese partners the Japan Exchange Group and Daiwa Institute of Research, the research arm of Daiwa Securities Group.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ