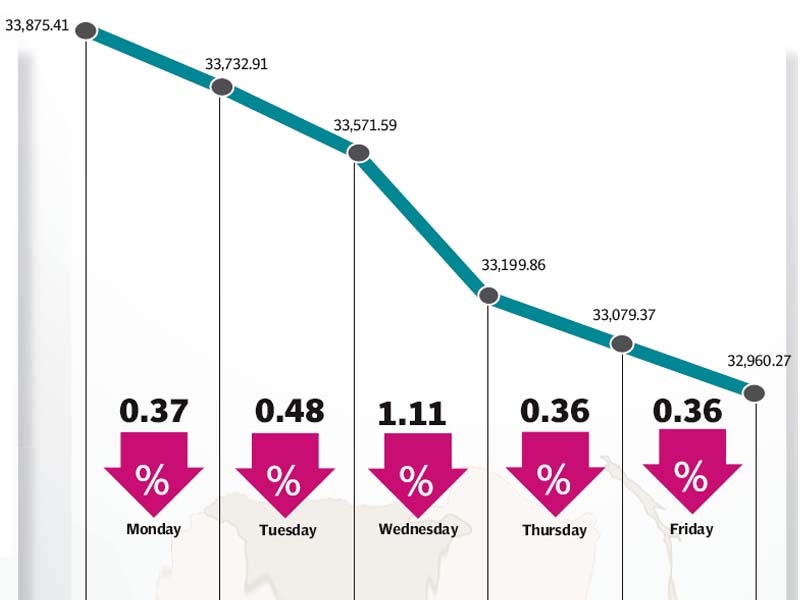

The stock market witnessed five straight days of negative close as foreign selling coupled with global tensions took their toll on the bourse resulting in the benchmark KSE-100 index falling 897 points (2.6%) to close at 32,960 during the week ended November 27.

With the State Bank deciding to keep the discount rate unchanged at 6.5% in the monetary policy announcement on November 21, the market was in dire need of positive news to rebound from the 288-point decline in the previous week. However, that wasn’t the case and tensions in the Middle East added to the anxiety.

Foreign selling was the biggest reason behind the week’s declines with foreigners offloading a net $13.1 million worth of equity during the week, following up on the $5.6 million net selling in the previous week.

The current year has been one of the worst ever in terms of foreign selling with foreigners selling equity worth a net $273 million during 2015. To put that number in perspective, foreigners have on average been net buyers of $224 million worth of equity in the past six years, according to statistics compiled by Elixir Securities.

At the same time, tensions flared up in the Middle East after Turkey shot down a Russian fighter jet after the plane allegedly violated Turkey’s air space. The news sent international markets into a tailspin with the effects trickling down to the local market, which saw high volatility during intra-day trading.

The banking sector led the declines despite the central bank’s decision to refrain from further discount rate cuts with index heavyweights MCB Bank, Habib Bank and National Bank leading the losses, falling 6.4%, 1.9% and 1.4% respectively during the week.

The oil and gas sector continued to reel from weak crude oil prices that remained below the $45 per barrel mark. Oil prices shot up mid-week after the tensions in the Middle East, however, they fell again after the latest US inventory figures confirmed that the supply glut is persisting.

The cement sector also continued to reel from fears that a price war is in the offing after Lucky Cement announced plans to expand in northern regions of the country last month. News also emerged that two Chinese firms were planning to set up cement manufacturing plants in Sindh, which put further pressure on the sector.

Average daily volumes fell sharply by 18.5% and stood at 143.3 million shares, down from 175.8 million shares in the previous week.

On the other hand, average daily values improved slightly and were recorded at Rs6.64 billion, up 0.6% over the previous week.

The Karachi Stock Exchange’s market capitalisation stood at Rs6.99 trillion ($66.9 billion) at the end of the week.

Winners of the week

Associated Services Limited

Earlier called the Latif Jute Mills Limited, the company is one of the industrial machinery and services firms in Karachi.

Mari Gas

Mari Gas Company Limited specialises in the drilling, production and selling of natural gas.

Sui Southern Gas Company

Sui Southern Gas Company Limited transmits and distributes natural gas, constructs high pressure transmission and low pressure distribution systems. The company’s transmission system extends from Sui in Balochistan to Karachi in Sindh, located in Pakistan.

Losers of the week

Jubilee General Insurance

Jubilee General Insurance Company Limited is a general insurance company which offers both individual life insurance and corporate business insurance. The company’s individual products include life, personal accident, critical illness, and investment insurance. Jubilee’s corporate products include group life, health, and pension schemes.

Pak Elektron Limited

Pak Electron Limited manufactures and sells a variety of electrical products and domestic appliances. The group’s power products include transformers, energy meters and switchgears. Their appliances consist of a range of deep freezers and air conditioners.

Fatima Fertilizer Company Limited

Fatima Fertilizer Company Limited produces fertilisers. The company is developing a fully integrated fertiliser complex, capable of producing Ammonia, Nitric Acid, Nitro Phosphate, Nitrogen Phosphorous Potassium and Calcium Ammonium Nitrate.

Published in The Express Tribune, November 29th, 2015.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ