After all, who can understand the ramifications of terrorism on foreign direct investment (FDI) better than Pakistanis? Amid bomb blasts and suicide attacks from one end of the country to another, Pakistan received the FDI of only $709.3 million in 2014-15, which is down over 58% from the preceding fiscal year and also marks the lowest point since 2002-03.

Can the persistent low levels of the FDI in recent years be attributed to the unending wave of terrorist incidents in Pakistan?

Empirical studies conducted by independent economists suggest that a slight uptick in the “perceived risk of terrorism” can lead to an “outsized reduction” in the FDI that a country receives, causing a “significant damage” to its economy.

Writing in the latest edition of Finance and Development, a premier quarterly publication of the International Monetary Fund (IMF), economists Subhayu Bandyopadhyay, Todd Sandler and Javed Younas noted that increased terrorism in a particular area tends to depress the expected return on capital invested there, which shifts investment elsewhere.

“This reduces the stock of productive capital and the flow of productivity-enhancing technology to the affected nation,” the economists wrote.

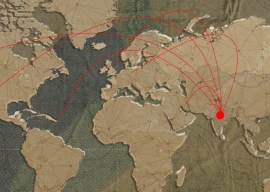

They reviewed the depressing effects of terrorism on 122 economies of the world for 1970-2011 and concluded that most countries with more than average terrorist incidents received lower FDI than the overall average among the 122 countries.

In the case of Pakistan, for example, the economists’ findings hold true. Pakistan’s average of 61.17 domestic terrorist incidents for the period under review far exceeds the average of 7.51 for the 122 economies.

The FDI Pakistan received on average over the same period constituted 0.79% of its GDP against the much higher average of 2.9% for the entire group of 122 economies, which proves the economists’ hypothesis.

It is difficult to assess causation, they say, but the study suggests a “troubling association between terrorism and depressed aid and foreign direct investment” for developing economies.

Another study conducted by the same group of economists using data from 78 economies for 1984-2008 revealed that a relatively small increase in a country’s domestic terrorist incidents per 100,000 persons “sharply reduced” the net FDI.

Furthermore, the study showed there was a similarly large reduction in net investment if the terrorist incidents originated abroad or involved foreigners or foreign assets in the attacked country. This finding is particularly relevant in the case of Pakistan where terrorists have repeatedly targeted foreign nationals and multinational businesses in recent years.

“The initial loss of productive resources as a result of terrorism may increase manifold because potential foreign investors shift their investments to other, presumably safer, destinations,” the study said.

Published in The Express Tribune, July 22nd, 2015.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS (2)

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ