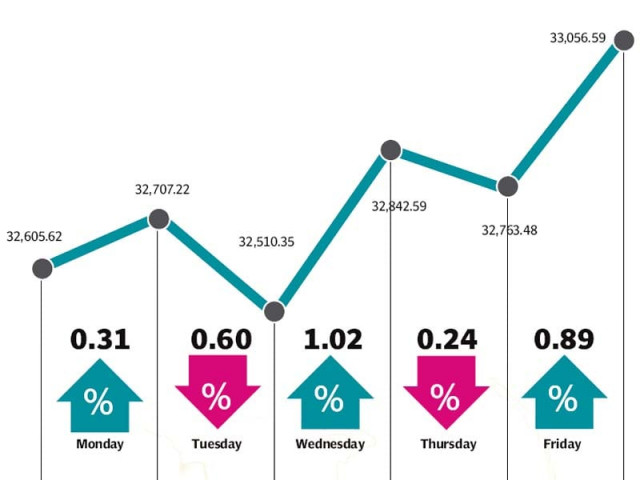

The central bank’s decision to cut the discount rate by 100 basis points fuelled a rally at the bourse as the benchmark KSE 100-share index gained 439 points (1.3%) to close above 33,000 during the week ended May 29.

The reduction in the discount rate and the introduction of a target rate was well received by investors and reflected in the healthy volumes seen during the week. However, details about a proposed hike in the capital gains tax (CGT) along with selling pressure in the banking sector acted as a dampener throughout the week.

The week started off on a positive note following the State Bank’s monetary policy announcement over the weekend. A rate cut was widely expected, but the decision to chop the rate by 100 basis points to 7%, a 42-year low, triggered heavy buying at the bourse.

The State Bank also announced a new target rate – the return paid on overnight deposits kept by banks with the SBP. The central bank revealed that it intends to equalise the policy and target rates in the future, hinting at further rate reduction.

Although the rate cut was positively received by the broader market, it came down heavily on the banking sector, which will see its spreads thin out further. The sector was the major casualty of the week and erased 60 points off the KSE-100 index, despite a strong performance by Habib Bank Limited.

During the week, the government also revealed its plans to increase the CGT on securities and also bring more of the stock market in the tax net. It proposed hiking the rates for both 0-1 and 1-2 years’ holdings to 15% and 12.5% respectively and also proposed 7.5% CGT on stocks held for more than two years.

The government also revealed proposals to increase taxes on the banking sector and increase the price of gas from July 1 to improve revenue generation. Overall, the budgetary news flow continued to negatively impact the market and left investors waiting anxiously for clarity on several fronts.

The discount rate cut was well received by the highly leveraged cement and high dividend-yielding electricity generation sectors. Both sectors cumulatively contributed 215 points to the KSE-100 index with the cement sector getting a further boost from the proposed hike in the public sector development programme.

Foreigners turned net sellers and offloaded equity worth $6.8 million as compared to $3.5 million worth of net buying in the previous week.

Average daily volumes shot up following the monetary policy announcement and stood at 186 million shares, up by 70.7% over the previous week. Similarly, average daily values rose 84.3% and stood at Rs9.6 billion.

The Karachi Stock Exchange’s market capitalisation stood at Rs7.18 trillion ($69.8 billion) at the end of the week.

Winners of the week

Hum Network Limited

Hum Network Limited operates satellite television channels. The company operates a channel targeted primarily at women, one about food, and one that covers lifestyle and entertainment.

TRG Pakistan

TRG Pakistan operates as an information technology company. The company provides business support and software services to companies. TRG Pakistan manages call centers and offices located in Pakistan and elsewhere throughout the world.

Pakistan Tobacco Company

Pakistan Tobacco Company Limited manufactures and sells cigarettes.

Losers of the week

Punjab Oil

Punjab Oil Mills Limited manufactures and sells vegetable ghee, cooking oil, and laundry soap.

Shezan International

Shezan International Limited manufactures and sells juices, beverages, pickles, preserves, and flavorings which are all derived from fresh fruits and vegetables.

Service (Shoes) Industries

Service Industries Limited specialises in manufacturing tires and tubes for motorcycles, bicycles, rickshaws and trollies. The company also produces footwear.

Published in The Express Tribune, May 31st, 2015.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ