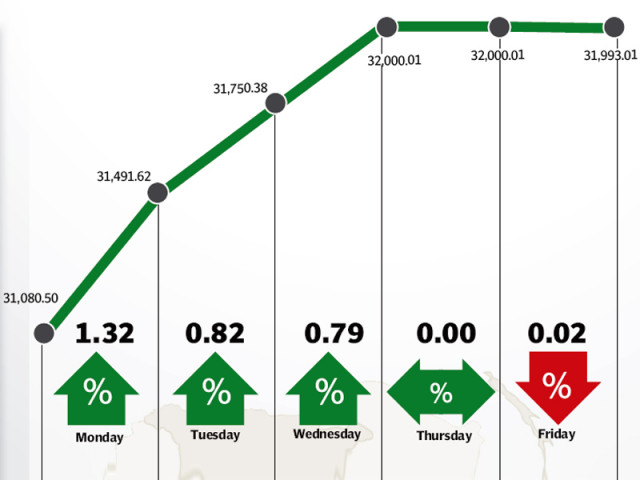

The stock market bounced back and recouped its losses from the previous week as heavy buying in blue-chip stocks resulted in the benchmark KSE-100 index climbing 982 points (3.2%) during the week ended December 26.

Despite a shortened week due to the December 25 holiday, the index put in a strong performance and climbed as high as 32,141 before receding slightly and closing right below the 32,000-point barrier at 31,993 at the end of trading on Friday.

Investors flocked towards blue-chip stocks during the week and healthy activity was witnessed in the banking, energy and fertiliser sectors during the week. Five stocks alone, namely MCB, UBL, OGDC, HUBCO and Engro Corporation, cumulatively contributed 524 points to the index’s gains.

The high activity coincided with the return of foreign buying at the bourse after four weeks of continuous outflows. Foreigners were net buyers of $7.8 million worth of equity during the week, a massive improvement over the net outflow of $30 million in the previous week.

During the course of the week, the International Monetary Fund also released the fifth and sixth installments of the standby programme which pushed the country’s foreign exchange reserves up to $15 billion before the year end which was also an important target of the IMF programme.

The banking sector was the star performer of the week as investors flocked towards banking stocks in anticipation of higher dividends for the year ended 2014 after the sector posted record profits in the preceding quarters. Similarly, it was a good week for the energy sector as global oil prices stabilised around the $60 per barrel mark and resulted in heavy buying in the sector due to attractive valuations. The sector on the whole was up 4% during the week, with Pakistan Oilfields leading the way with a gain of 4.6%.

OGDC and PPL also saw gains with PPL announcing significant new discoveries in the Gambat South block. Yield plays in the energy sector like Hubco and Kapco were also in the spotlight due to anticipation of good payouts at year end.

Engro Corporation put in a strong performance and rose 5.2% during the week after the Economic Coordination Committee approved the continuation of 60 mmcfd supply to the company’s fertiliser plant for another 12 months.

Average trading volumes showed an improvement and were up by 10.7% at 224 million shares traded per day. However, average daily values fell 9.6% and stood at Rs10.8 billion daily. The Karachi Stock Exchange’s market capitalisation stood at Rs7.3 trillion ($ 72.3 billion) at the end of the week. It has been a stellar year for the Karachi Stock Exchange with the KSE-100 posting a gain of 20.8% in the last 12 months. The index currently stands near its all-time high but remains at an attractive multiple compared to its regional peers. That being said, foreign flows and global oil prices will determine the direction of the market as it enters 2015.

Winners of the week

Pakistan Tobacco Company Limited

Pakistan Tobacco Company Limited manufactures and sells cigarettes.

Arif Habib Corporation

Arif Habib Limited operates as a securities brokerage company. The company offers securities brokerage, investment research, and corporate finance services to customers throughout Pakistan.

NIB Bank

NIB Bank Limited is a commercial bank operating in Pakistan.

Losers of the week

Murree Brewery

Murree Brewery Company Limited specialises in the manufacture of beer and Pakistan made foreign liquor. The group also has juice extraction and food manufacturing divisions, located at Rawalpindi and Hattar respectively. Their glass division manufactures all the group’s bottles and jars.

Mari Gas

Mari Gas Company Limited specialises in the drilling, production and selling of natural gas.

Archroma Pakistan Ltd

Archroma Pakistan Limited supplies chemicals and dyes to enhance the properties of clothing and textiles in such diverse applications as high fashion apparels and articles for home textiles.

Published in The Express Tribune, December 28th, 2014.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ