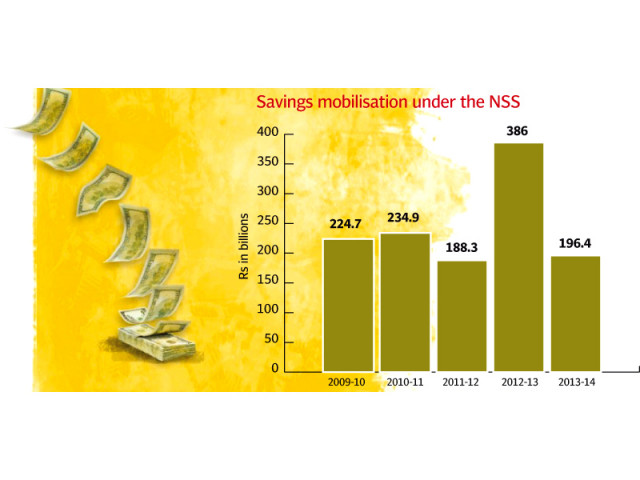

National schemes: Savings mobilisation declines 49% in FY14

Amount to Rs196.4b; analysts explain regression due to high savings recorded in 2012-13.

Savings mobilised under the National Savings Schemes (NSS) in 2013-14 amounted to Rs196.4 billion, which is almost half of savings mobilisation achieved during 2012-13.

According to data released by the State Bank of Pakistan (SBP) on Thursday, savings mobilised under the NSS during the last fiscal year were 49% less than the mobilisation of Rs386 billion recorded in 2012-13.

In June alone, the amount of savings in a number of schemes under the NSS umbrella clocked up at Rs22.2 billion, which is 56.3% less than the comparable figure of Rs51 billion recorded in June 2013.

Analysts believe the substantial drop in savings mobilisation in the last fiscal year is because of the unusually high savings recorded in 2012-13. In other words, the decline in savings under the NSS in 2013-14 appears substantial because of the high-base effect.

Savings mobilisation recorded a rapid increase in 2012-13 when it surged by a massive 105% to Rs386 billion from Rs188.3 billion in 2011-12.

NSS mobilisation in 2012-13 had increased substantially when interest rates declined in the wake of the SBP’s lowering of the discount rate.

But the central bank raised the discount rate twice by 50 basis points each in the first half of 2013-14 and then kept it flat at 10% for the rest of the fiscal year. This led to higher interest rates in the economy, thus resulting in slower mobilisation of savings under the state-run NSS during 2013-14.

Savings mobilisation under the NSS remained Rs224.7 billion in 2009-10, Rs234.9 billion in 2010-11, Rs188.3 billion in 2011-12, Rs386 billion in 2012-13 and Rs196.4 billion in 2013-14. This translates into a compound annual growth rate of a negative 3.3% per annum for the last four fiscal years.

The decline in NSS mobilisation in recent years is arguably a positive development for the country. Government borrowings under the NSS are categorised as ‘unfunded debt’ and should thus be minimised. According to the Ministry of Finance, the share of unfunded debt in the government’s total domestic debt stood at Rs2.2 trillion, or 21%, at the end of March.

During the first nine months of the outgoing fiscal year, most of the incremental mobilisation went into Bahbood Savings Certificates (Rs41 billion) and Regular Income Certificates (Rs34 billion).

The government last revised the rates of return on the NSS on January 1. Bahbood Savings Certificates now offer a return of Rs14.04% per annum while the interest paid on Regular Income Certificates is 11.88% per annum.

The government has also linked profit rates on major NSS instruments with the yield on Pakistan Investment Bonds besides imposing withholding tax on profits and service charges/penalty interest on early redemption.

Published in The Express Tribune, July 25th, 2014.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ