Market watch: Index slips as caution prevails

Benchmark KSE-100 index declines 107.81 points.

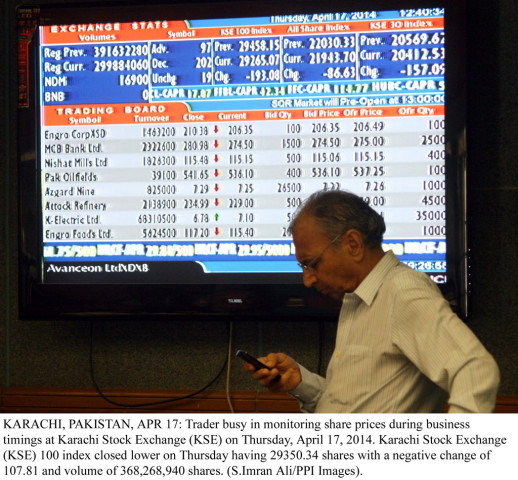

Meanwhile, according to Faisal Bilwani from Elixir Securities, equities settled in red after volatile trading and high turnover, the likes of which was last seen in July 2013. PHOTO: PPI

The Karachi Stock Exchange’s (KSE) benchmark 100-share index fell 0.37% or 107.81 points to end at 29,350.34.

“Lucky Cement (- 2.6%) led the decline with the cement sector ending up as the major loser of the day,” said Ahsan. “News that the finance ministry has forwarded OMCs request of increasing margins to the ECC for final approval failed to ignite a rally in PSO (PSO -1.93%) as investors chose to sell on news.

“K-Electric Limited (KEL +5.0%) led the volume chart with 99 million shares of the company exchanging hands,” said Ahsan.

“The high volumes in the utility signalled strong investor confidence in the turnaround story at K-Electric as the current management has almost miraculously reduced transmission and distribution losses to 29% from almost 40% five years back when the current management took over. Overall, he added, the trend of the market is expected to remain bullish with the banking sector likely to lead the rally going forward.

Meanwhile, according to Faisal Bilwani from Elixir Securities, equities settled in red after volatile trading and high turnover, the likes of which was last seen in July 2013.

“Stocks opened positive carrying on the momentum and on excitement over foreign flows. However, profit-taking at highs pulled benchmark KSE100 near 29k,” said Bilwani, adding that reported institutional buying helped broader market to close at a much respectable 29,350 level.

“Engro Foods (EFOODS PA -0.3%) announced 1Q earnings beating estimates on better than expected margins and closed red in line with the broader market.

“Attock group earnings were a dampener and did play a key role in hurting sentiment with Pakistan Oilfields (POL PA -1.6%) 3Q missing consensus,” said Bilwani, adding that the only respite came from United Bank Limited (UBL PA +3.3% ) that weathered and ignored market moves and stood firm to close at fresh record highs.

“We see volatile trading ahead of the weekend with volumes possibly on lower side primarily from foreign institutions owing to the Good Friday holiday,” said Bilwani.

Trade volumes rose to 496 million shares compared with Wednesday’s tally of 391 million.

Shares of 370 companies were traded on Thursday. At the end of the day, 112 stocks closed higher, 242 declined while 16 remained unchanged. The value of shares traded during the day was Rs17.04 billion.

K-Electric Limited was the volume leader with 99 million shares, gaining Rs0.34 to finish at Rs7.12. It was followed by NIB Bank Limited with 48.6 million shares, gaining Rs0.07 to close at Rs2.88 and Faysal Bank limited with 28.1 million shares, gaining Rs0.66 to close at Rs17.05.

Foreign institutional investors were gross buyers of Rs480.9 million during the trading session, according to data maintained by the National Clearing Company of Pakistan Limited.

Published in The Express Tribune, April 18th, 2014.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ