KSE weekly: Not much to write home about

Regional markets continue volatile run while KSE closes for Eid holidays.

Regional markets continue volatile run while KSE closes for Eid holidays.

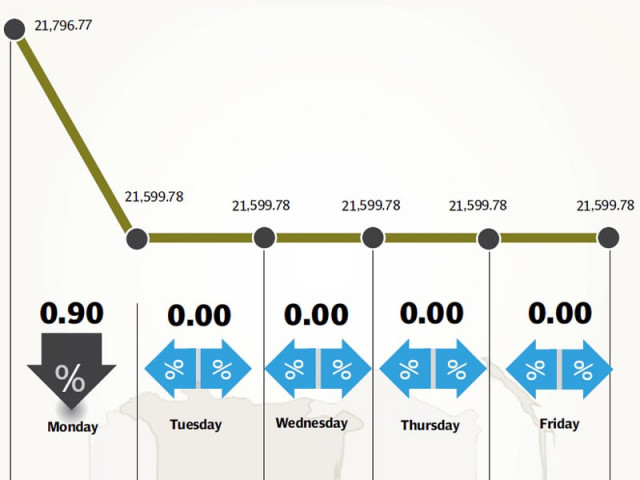

The Karachi Stock Exchange (KSE) had little to report this week, trading only on Monday prior to the national Eid holidays. However investors chose to sell off their stocks on that day as well, preferring instead to wait for the market to pick up after Eid.

The KSE has been volatile for months due to several factors. First and foremost of which has been the rising interest rates in Pakistan and uncertainty in the banking sector. After the State Bank announced its decision to raise interest rates, investors expected the banking sector to lead the bourse through higher profits. However a relatively unexpected announcement by the regulatory body to raise minimum deposit rates shortly after, which in turn cut banking profits, created uncertainty in the sector which has seen stocks fall ever since.

The increase in interest rates also creates a liquidity crunch, as investors who would have generally invested the money in private markets now prefer to store it in banks for a higher, and less risky, return.

But Pakistan has also been susceptible to international shocks which have affected regional markets as well. The biggest of these has been uncertainty over the United State’s (US) Quantitative Easing Programme, which effectively sees the American Federal Reserve (Fed) dump $85 billion dollars monthly into the US market to prevent prices from collapsing, in turn pushing the dollar down. Recently the head of Federal Reserve, Ben Bernanke, announced that the government might consider tapering off the programme on the basis of better unemployment figures which reflected an improving economy. This led to capital outflow from emerging and frontier markets, but investors were forced to scramble yet again when the Fed announced that it would wait for more data before cutting down the programme; data which might take up to six months.

This was exacerbated by the two-week government shutdown in America which ended before rumours of a possible American default, the first major western economy to do so since fascist Germany before the Second World War, could gain more credibility.

However foreign portfolio investment has been unwilling to return to regional markets, a fact evidenced by the dramatically low volumes in the KSE.

While some analysts hope that volumes will pick up next week post the Eid lull, we will have to wait and see which direction foreign investors will take. Increased volumes caused by local interest may be enough to attract foreign investment, but investors are optimistic about foreign interest in the market in the wake of the 3G auction.

Winners of the week

Security Papers

Security Papers Limited manufactures paper for banknotes, financial instruments, watermarked university degree certificates, and other types of security papers. The company supplies its products in Pakistan and elsewhere throughout the world.

IGI Insurance

International General Insurance Co of Pakistan Limited provides property and casualty insurance products and services. The company’s products include fire, marine, and motor insurance.

Askari Commercial Bank Limited

Askari Commercial Bank Limited provides commercial banking services. The bank has branches in Pakistan, Azad Jammu, Kashmir and Bahrain.

Losers of the week

Hum Network

Hum Network operates satellite television channels. The company operates a channel targeted primarily at women, one about food, and one that covers lifestyle and entertainment.

Engro Corporation

Engro Corporation produces fertilisers, polyvinyl chloride resin, and industrial automation products, develops electricity generating plants, produces dairy foods, and operates a liquefied petroleum gas and liquid chemical terminal.

Millat Tractors

Millat Tractors Limited assembles and manufactures tractors, implements, and equipments.

Published in The Express Tribune, October 20th, 2013.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ