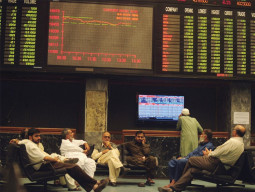

The Karachi Stock Exchange’s (KSE) benchmark 100-share index fell 0.55% or 120.68 points to end at 22,015.04 points.

Trade volumes were flat at 302 million shares compared with Wednesday’s tally of 306 million shares. The value of shares traded during the day was Rs9.54 billion.

“The market dipped after treading in the positive territory for most of the day, as a selloff in regional markets spooked investors,” commented JS Global Capital analyst Ovais Ahsan.

“With the growing realisation that Pakistan is entering a new International Monetary Fund programme and that there is no confirmation of a Saudi deferred oil payment programme, investors fear stricter conditions and that an uptick in interest rates is on the cards,” he added.

Shares of 372 companies were traded on Thursday. At the end of the day, 122 stocks closed higher, 219 declined and 31 remained unchanged.

“Index heavyweights Oil and Gas Development Company (down 0.9%) and MCB Bank (down 1.7%) led the decline, as persistent selling by one of the largest foreign investor funds weighed on the price and sentiment,” Ahsan reported. “Pakistan State Oil (down 2.2%) also lost intraday gains, as a solution to the circular debt still remains hypothetical.”

Bank of Punjab (rights issue) was the volume leader with 88.65 million shares, losing Rs0.06 to finish at Rs2.46. It was followed by TRG Pakistan with 18.26 million shares, gaining Rs0.37 to close at Rs11.26 and Bank Alfalah with 17.56 million shares, gaining Rs1.00 to close at Rs19.02.

“The cement sector also weakened, as rising interest rates will push up borrowing costs for one of the most leveraged sectors in the market,” Ahsan added.

Foreign institutional investors were buyers of Rs602.87 million and sellers of Rs316.53 million worth of securities, according to data maintained by the National Clearing Company of Pakistan Limited.

Published in The Express Tribune, June 21st, 2013.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

-(1)1714116455-0/Heeramandireactions-(2)-(1)1714116455-0-270x192.webp)

1714024018-0/ModiLara-(1)1714024018-0-270x192.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ