The national exchequer suffered a loss of Rs80 billion between 2007 and 2011 in the shape of lower tax revenues due to an influx of contraband cigarettes in the country, claims a recently-released report that examines the tobacco industry. These losses are expected to grow by another Rs100 billion in the next five years if concrete measures are not taken by government departments.

The report, released by Euromonitor, assessed the illicit cigarette trade in the Asia Pacific region. It reveals that Pakistan stands number three in terms of the trade of contraband cigarettes with every one cigarette out of four sold being illicit, behind Malaysia and Hong Kong.

According to the report, trade in contraband cigarettes in Pakistan reached a peak of 23.5 billion sticks in 2011. These local duty-not-paid (DNP), smuggled and counterfeit cigarettes represent 26.7% of Pakistan’s total cigarette consumption in terms of volume.

Pakistan’s huge illicit cigarette trade is fuelled by two key components: high tax incidence and weak enforcement of anti-illicit trade laws. According to the report, taxes make up 68.7% to 81% of the retail price of a cigarette packet, which is considerably high given the low purchasing power of the average Pakistani consumer. This in turn inflates the price differential between legal and illicit cigarettes; creating a natural shift away from legitimate trade, as smokers can easily purchase duty-evaded cheap cigarettes at a fraction of the duty-paid price.

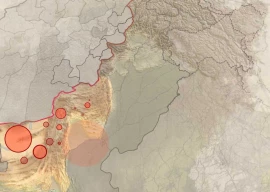

Pakistan’s illicit cigarette trade comprises three main types: namely, local DNP, which is 84.5% of the illicit market with 19.9 billion sticks sold in 2011; smuggled cigarettes, which comprise 12% of the illicit market with 2.8 billion sticks sold; and counterfeit cigarettes, which comprise 3.5% of the illicit market with 0.8 billion sticks sold.

The report says that between 2002 and 2011, the global illicit cigarette trade contracted by 7.3%, whereas in Pakistan, it witnessed a growth of 113.6% in the same period. In fact, the volume of illicit cigarettes sold more than doubled from 11 billion sticks in 2002, to 23.5 billion sticks in 2011. The report said that, in 2010, the national exchequer suffered a loss of Rs17.6 billion in tax revenues: in 2011, this loss reached around Rs18.5 billion (an increase of 5%).

The report guesstimates that this market is expected to continue to grow by 15% over the period between 2011 and 2015 due to a lack of law enforcement by relevant government agencies.

The Pakistani cigarette industry is basically a duopoly dominated by the Pakistan Tobacco Company and Philip Morris Pakistan, although there are many other smaller manufacturers. Pakistan Tobacco Company has a 48.6% share of the market, followed by Philip Morris Pakistan with 32.2%. Others contribute 19.2%. These companies bear a tax burden within the industry of 67.3%, 31.9% and 0.8% respectively.

Pakistan Tobacco Company is the single-largest taxpaying unit in Pakistan. The company pays more taxes than all salaried individuals in the country combined.

The company’s gross turnover for 2012 stood at Rs75.53 billion (12% higher than the previous year), out of which it paid a whopping Rs39 billion in excise duties (Rs35 billion in the previous year) and an additional Rs11 billion in sales taxes (Rs10 billion in the previous year).

Meanwhile, Philip Morris Pakistan paid Rs5.04 billion in sales taxes in 2012, and another Rs16.96 billion in excise duties for the same period.

Published in The Express Tribune, March 16th, 2013.

Like Business on Facebook to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ