The buyers think that the economics just does not work, but the petroleum ministry seems hell-bent on importing liquefied natural gas anyway.

Testifying before the National Assembly Petroleum and Natural Resources Committee, Petroleum Secretary Ijaz Chaudhry admitted that the power sector, the manufacturing sector and fertiliser producers had all balked at the idea of purchasing imported LNG at a cost of $18 per million British thermal units (mmbtu), the prevailing international price at which the government would be able to import LNG.

Chaudhry said that the government’s plan had been to get the LNG import terminal developers to find the end buyers of the gas, which they had apparently failed to do, largely due to pricing concerns. Even power companies – which are currently relying on highly expensive furnace oil – have turned down the idea of buying LNG at its market rate.

“Power companies have told us that they would rather shut down than have to pay $18 per mmbtu,” Chaudhry told the committee. “[This is despite the fact that] the power companies are currently buying furnace oil at a rate of about $20 per mmbtu.”

Most of the largest industrial consumers of natural gas have suggested that the government create a weighted average formula for gas pricing, with the lower local price of gas offsetting the higher international price. The petroleum ministry seems to be considering the idea.

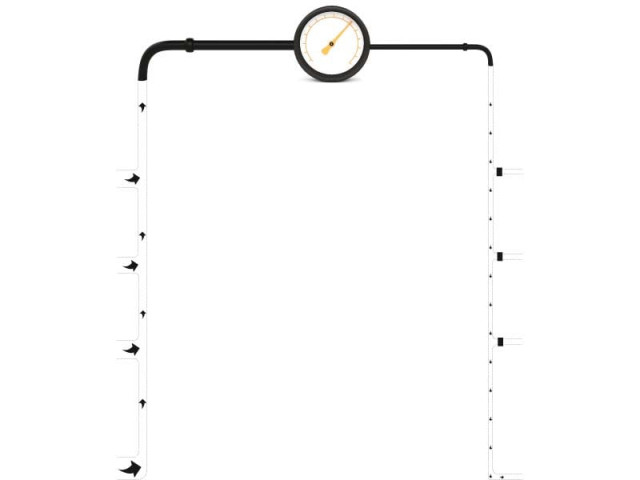

“We are now working to put the imported LNG into the pipeline systems of [state-owned] Sui Northern Gas Pipelines and the Sui Southern Gas Company and to charge a weighted average price for the gas from manufacturers, the fertiliser sector and the power sector,” said Chaudhry during his testimony.

The petroleum secretary appeared to be confident that despite what amounted to open rebellion by the major buyers of the gas, the country would be able to begin importing LNG within the coming year.

Domestic production

But importing LNG is not the only component of the government’s plan to combat the gas crisis that has seen the gas shortage in the country jump to as high as 2,100 million cubic feet per day (mmcfd) during peak winter demand.

The petroleum ministry had submitted a draft of a new petroleum policy that would pay companies exploring and developing domestic supplies of oil and gas a rate of $6 per mmbtu, significantly higher than the current rate which can often be lower than $3 per mmbtu. Oil and gas companies have been demanding higher prices because the cost of exploration has gone up since the last policy was announced in 2001.

Chaudhry said that while the government had some disputes with the provinces over who would exercise regulatory authority over oil and gas companies, there was agreement on the new, higher price to be paid to domestic producers. The hope is that higher prices will attract more companies into exploring and producing more domestic oil and gas, which is much cheaper than any imported options.

Pipeline imports

Another option the government is aggressively pursuing is importing gas from Iran and Turkmenistan via pipelines. Both pipelines are more expensive that local production, but cheaper than LNG imports. Gas from the Iran pipeline would cost $11 per mmbtu and from the Turkmenistan pipeline about $13 per mmbtu.

The petroleum secretary also refuted the allegations that Pakistan might give in to US pressure to abandon the Iran pipeline.

“The route survey of the pipeline has been completed and companies have been shortlisted for the engineering, procurement and construction contracts,” he said, adding that the government was already in the process fof acquiring the land for the pipeline.

If completed on time, gas would begin to flow from Iran by 2014.

Possible CNG ban for private cars, industry to get gas on ‘as available’ basis

The petroleum ministry has sought political consensus from Parliament for what appears to be an aggressive gas load management plan, aimed at constraining the growth in demand for natural gas.

In his testimony before the National Assembly Petroleum and Natural Resources Committee on Tuesday, Petroleum Secretary Ijaz Chaudhry explained the government’s challenges in managing the nation’s dwindling reserves of gas and laid out a plan for rationing the available gas between the various sectors that use it.

The plan calls for raising prices on compressed natural gas (CNG) used as fuel by vehicles, switching from guaranteed supply to “as available” contracts for captive power plants in industrial units, banning the use of CNG in private vehicles and linking expansions in gas allocations to additions of supply to the gas grid.

“No sector is ready to cooperate [with the government] on the gas load management plan,” said Chaudhry.

CNG

Effective Wednesday, CNG will now be subject to a 10% infrastructure development cess. CNG prices in Khyber-Pakhtunkhwa, Balochistan and the Potohar region (Islamabad, Rawalpindi and Gujjar Khan) will now be Rs74.30 per kilogramme, while those in the rest of the country will be Rs69.62.

In addition to the tax, the government is planning on increasing the base prices of CNG. “We have an agreement with the CNG lobby to keep prices at 55% of petrol,” said Chaudhry. “We are requesting the economic coordination committee (ECC) of the cabinet to revise this formula.”

The government had also considered lowering diesel prices as a means of encouraging alternatives to CNG, but the price differential was simply too great to achieve any meaningful reduction in CNG consumption without raising CNG price. In the meantime, the government was considering simply banning the use of CNG in all vehicles except public transportation.

“A ban on CNG use in cars with engines over 1,000 cubic centimetres would be challenged in the courts as discriminatory,” said the secretary. “We are currently studying a plan to ban the use of CNG in private vehicles, which would reduce gas consumption in that sector by 50%.”

Captive power in industry

The petroleum secretary confirmed that the nine-month gas supply agreements that the state-owned gas companies had with captive power plants in large industrial units were not being honoured.

“The decision to enforce these agreements needs to be made politically,” said the secretary. “We are going to revise these agreements with industry to provide gas to them on an ‘as available’ basis.”

Managing supply growth

The petroleum secretary also said that the government should only expand allocations of gas in the same proportion as new supplies of gas to the national system. Chaudhry was met with some hostile questioning when he stated that the state-owned Sui Northern Gas Pipelines and Sui Southern Gas Company had invested Rs250 billion over the last five years in expanding the gas network under development schemes supported by parliamentarians.

“SNGP had imposed a moratorium on new connections 2009, but 90% of new connections went to the domestic consumer sector through parliamentarians,” he said. He then laid out more numbers that suggested that political interference was hampering the ministry’s ability to manage the gas load. “About 180 million cubic feet per day (mmcfd) of gas supply capacity was added to the network last year, but the gas shortfall increased by 270 mmcfd, largely due to the spread of new connections under the prime minister’s directives to provide has to development schemes backed by parliamentarians.”

He also added: “The Oil and Gas Regulatory Authority (Ogra) relaxed the ban on new CNG stations and issued 400 new licences.”

Published in The Express Tribune, February 1st, 2012.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ